|

Selling your home is a big step. How do you know you’re ready to sell your home? Here are 8 signs that you’re in a good position to sell your current home and buy a new one.

1. You have positive equity in your home

Equity is the difference between what your house is worth and what you owe on your mortgage. So if your house is worth $300,000 and you owe $200,000, then you have $100,000 of positive equity. Most homeowners have positive equity in their homes, but it’s possible to have negative equity if your home is now worth less than what you paid for it. How much equity do you need to sell your home? Unless you have to do so to avoid foreclosure, don’t sell your home unless you can sell it for more than you bought it for. In terms of what you need to buy a new home, it’s best to have enough money from the sale of your current home to make a 20% down payment on a new home and to be able to pay for closing costs and moving expenses.

2. You’re free from debt outside of your mortgage

The best case scenario for buying a new home is that you are financially secure, with no debt outside your mortgage and enough cash in an emergency fund for at least 3 months of expenses. However, it is possible to carry some debt outside your mortgage and still be approved for a loan for a new home. Lenders will look at your DTI, or debt to income ratio to decide if you’re eligible for a loan. A favorable DTI is less than 43%. To figure out your DTI, add up all your monthly debt and divide it by your monthly income. For example, if your monthly debt is $500 and your income is $3,000, then your DTI is 16%.

5. You have cash for home improvements

In order to get the most out of the sale of your current home, it may be necessary to make some upgrades. Typically, the best places to invest money are in paint jobs, the exterior of the house, and upgrades to the kitchen and bathrooms. Home improvements aren’t a must-have, but having the cash on hand to update your home and maximize its value is a good sign you’re ready to sell.

6. You're emotionally ready to sell

While you may be in good financial shape to sell your home, it’s also important to assess whether or not you are emotionally ready. Can you handle the criticism of your home that potential buyers may make without taking it personally? Are you ready to let go of the memories that you created in your home? Are you prepared to put in the work to get your home ready for the market and keep it ready to show for weeks or months? These are some of the questions you will need to answer in order to determine if you’re emotionally ready to sell.

7. Your current home no longer fits your needs

Whether you need more space to accommodate new family members or you’re ready to downsize, it’s important to assess whether your current home fits your needs. Changes in your family size or lifestyle indicate that you’re ready to sell.

8. You’re in a sellers market.

Do some research and find out the state of your local market. If you're in a seller’s market, meaning that demand for homes is greater than the number of homes available, it’s a good time for you to sell. In a seller’s market you’re likely to get multiple offers on your home that are competitive and you’ll be able to make money off the sale of your home, which is always the outcome you want as a seller.

In summary, to determine if you’re ready to sell your home, you’ll want to take stock of your financial situation, your emotional situation, and the state of the local market. If these three factors are all working in your favor, it’s a sure sign that you’re ready to make the move of selling your home.

6 Comments

Most of us are familiar with traditional staging; the act of decorating and furnishing a home for sale to appeal to potential buyers. A well staged home can produce stunning listing photos that will encourage buyers to tour the home. It can also help buyers envision themselves living in the house. In recent years, a new trend has emerged in home staging: virtual staging.

What is Virtual Staging?

Virtual staging takes photos of empty rooms and then uses photo-editing software to add in attractive furniture and decor (like mirrors, plants, rugs, etc). While it is possible to download a DIY staging software, typically, you will get the best results by having a professional company virtually stage the photos. It’s also important that the photos you use are high-quality, preferably taken by a professional photographer.

Why opt for Virtual Staging?

When compared to traditional staging, virtual staging is much less expensive and saves the hassle of moving lots of furniture into the house or painting several rooms. According to realtor.com, “the average cost for most stagers is $300 to $600 for an initial design consultation, and $500 to $600 per month per staged room.” By comparison, most virtual staging companies will charge between $50-$200 per room depending on how much redecoration the room requires. Virtual staging can even include decluttering or “painting” rooms. In addition to saving money, virtual staging can be done quite quickly. Most companies offer a 2 day turn around on your photos.

Keep in Mind:

Bad virtual staging can immediately turn buyers off from perusing your listing photos and make them write off visiting your home. Alternatively, when you use a professional company, you should have a disclaimer in the caption of the photo that it has been virtually staged so the buyer is aware that when they visit the house, it will not look the exact same as the photos. You may decide you want to include the original photos of the empty rooms with the staged photos for this purpose. Virtual staging is not intended to trick buyers; it is a tool sellers use to help showcase a property while providing depth to the rooms so buyers can envision the space better. Ultimately, you may still decide to physically stage your house or use a mix of virtually and traditionally stages rooms for your listing. As always, a realtor can offer great advice and guidance for your particular situation.

Sources:

https://www.homelight.com/blog/home-staging-tips-first-timers/ https://www.realtor.com/advice/sell/what-is-virtual-staging-home-selling/ https://www.homelight.com/blog/virtual-staging-sell-home-faster/ https://www.realtor.com/advice/sell/how-much-does-home-staging-cost/ https://www.forbes.com/sites/ellenparis/2019/11/18/an-increasing-number-of-real-estate-agents-are-choosing-virtual-staging-to-lure-buyers-to-their-listings/#41e61b8b3432 https://www.redfin.com/blog/impress-buyers-with-virtual-staging/ https://www.inquirer.com/real-estate/housing/virtual-staging-home-sales-philadelphia-20200415.html

If you are considering putting your house on the market in the near future, you may be wondering what prospective homebuyers are looking for before investing in a home improvement project. Afterall, you don’t want to sink a lot of money and time into an upgrade that won’t appeal to buyers. These improvements go beyond fixing major issues that would come up during a home inspection (which should be addressed prior to putting your house on the market) or quick/ inexpensive fixes like cleaning the carpets or fixing chipped paint. So, what do buyers want in a house?

Renovated or Updated Kitchen

According to realtor.com, a survey they conducted in early April of this year found that 13.3% of 1,300 surveyed (both renters and owners of houses) rated an updated kitchen a must have for their next home. The 2019 Realtor Remodeling Impact Report found that 40% of realtors recommend sellers update their kitchen before listing their home (and 20% said it helped close a sale). Now more than ever, the COVID-19 pandemic has encouraged more people to cook at home, thereby making a kitchen with updated appliances a sought-after commodity. Check out these blog posts on counters, cabinets, and DIY renovation tips for more ideas on how to update your current kitchen. Also keep in mind that 75% of agents surveyed in HomeLight’s Q3 2019 Top Agent Insights Report said that stainless steel appliances are the most in demand appliance finish among buyers.

Hardwood Floors

Gone are the days of wall-to-wall carpeting, homebuyers of recent years want hardwood floors. This home project has one of the best ROIs you can find in home remodeling; there is a 106% cost recovery of new hardwood flooring and 100% cost recovery to refinish existing hardwood floors (according to the same Realtor Remodeling Impact Report). If hardwood throughout the house is not in the budget, opting for another hard surface, like laminate, is still preferred over carpeting. Prioritize the main living areas and keep the carpet in the bedrooms if you can’t update all the flooring. The best practice is to keep the flooring consistent in the house by using the same color and material in all the rooms you plan to make hard surface floors.

Modern Bathrooms

Buyers today want modern interiors with clean lines. Bathrooms are similar to kitchens in that they are a high traffic area for family members and so they can wear out faster than other rooms in the house. Buyers like bathrooms with big showers that give off a spa-like environment. If you are not in a position to remodel a bathroom, re-grouting tile and replacing water stained ceilings will go a long way to refresh the space.

Attractive Exterior

Even if you have all the amenities a prospective buyer could dream up inside your home, it’s the exterior of the house that will immediately create an impression on the buyers before they even step foot inside. Create some curb appeal to ensure you impress the buyer from the start. For a quick and relatively inexpensive face-lift, keep the yard mowed and powerwash the exterior of the house. Homebuyers also want ample exterior lighting for both aesthetic and safety reasons. If you can take on a bigger project, the number one outdoor feature buyers want in a house is a patio. Check out this blog post for tips on how to upgrade your existing patio or talk to a contractor about building one.

Neutral Walls

To get an offer on your house it’s important to help potential buyers envision making your house their new home. There are several ways to accomplish this, particularly with proper staging, but one of the best ways is to paint all the walls neutral colors. A neutral palette (think whites and grays) makes the furniture pop and gives the home a move-in ready appearance.

Storage

Let’s face it, Americans today have a lot of stuff. Minimalism, while trendy, is a challenge for most of us. We want to live in simple, calm spaces without sacrificing our beloved possessions. This creates a demand for more storage areas in the house. Homebuyers want walk-in closets, garages with shelving, large pantries, and laundry rooms. While it’s not always possible to create these spaces if they are not part of your floorplan, with a bit of creativity, you can still improve these areas. Try installing an organizational system with shelves and hanging rods to optimize the space in a reach-in closet. Similarly, you can add shelves and a peg wall for tools to increase the storage capacity for your garage or even invest in a shed.

Energy Efficiency and Smart Technology

According to 2019 survey results from the National Association of Home Builders (NAHB), energy-saving features such as Energy Star appliances, windows and whole house certification are among the most wanted home features. Buyers are willing to spend a little more upfront in the interest of saving money on utilities down the road. In addition to replacing old windows and appliances with energy-efficient ones, consider installing ceiling fans and smart thermostats which will also help lower utility costs. You may also decide to upgrade your insulation which boasts a recovery value of 83%. Be sure to have these features highlighted in your listing since they can be overlooked in a typical home tour.

When in doubt about which projects to focus on, ask your realtor! They will have the most up-to-date data and trends, plus know what appeals to buyers specific to your local housing market.

Sources:

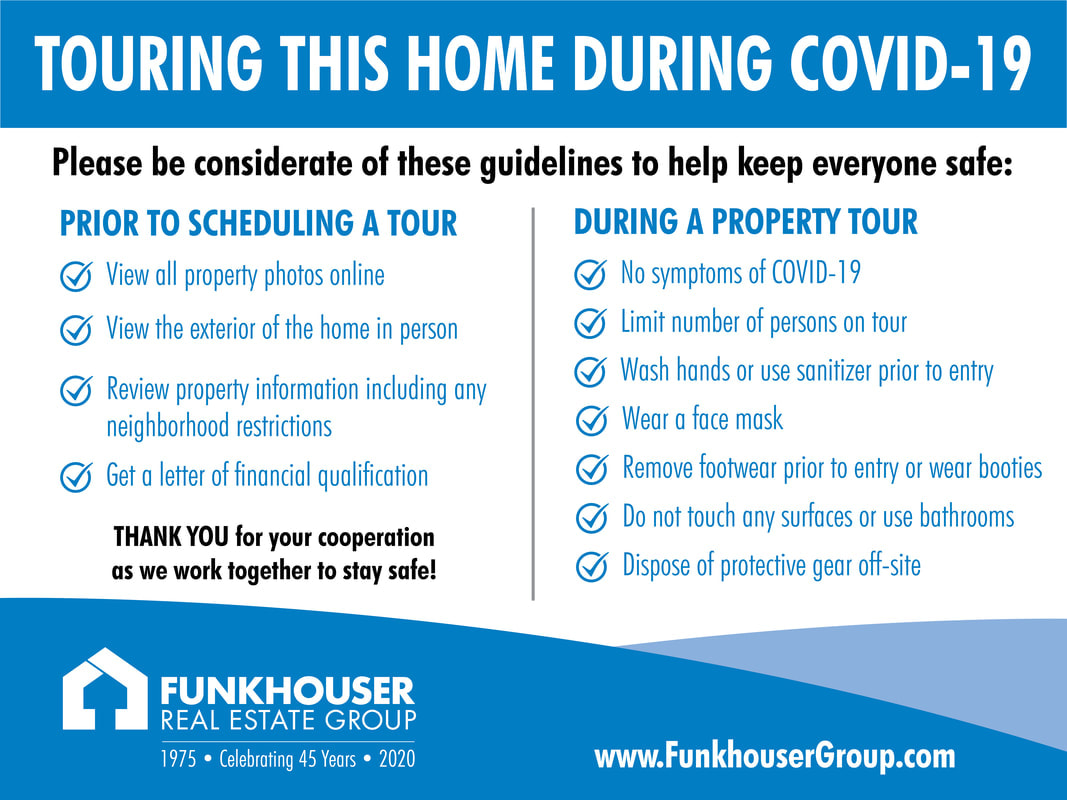

https://homelightblog.wpengine.com/what-buyers-want-in-a-home/ https://www.nar.realtor/research-and-statistics/research-reports/remodeling-impact https://www.houselogic.com/sell/preparing-your-home-to-sell/important-repairs-to-make-before-selling-a-house/ https://www.hsh.com/homeowner/home-features-buyers-want.html https://www.kiplinger.com/slideshow/real-estate/t010-s001-home-features-that-buyers-want/index.html https://www.realtor.com/research/top-consumer-home-features-coronavirus/ https://www.homelight.com/blog/what-flooring-increases-home-value/ https://www.nahb.org/News-and-Economics/Industry-News/Press-Releases/2019/02/NAHB-Outlines-Top-Features-Home-Buyers-Want-for-2019 https://www.homelight.com/blog/do-new-windows-increase-property-value/  Client Care Packages provided by Funkhouser Group Client Care Packages provided by Funkhouser Group Even in the face of COVID-19, the real estate market in Shenandoah Valley remains active. Funkhouser Group has put several precautions in place so potential buyers and sellers can continue to purchase or sell homes while social distancing. At this time, buyers should do the following before scheduling a tour:

Yard Sign Options for Sellers Yard Sign Options for Sellers These guidelines are listed on a yard sign that is available to all sellers working with Funkhouser Group. Additionally, there are safety measures listed for property tours as well. These include:

If you are closing on a house as a purchaser or seller, you may be wondering what that process looks like during the COVID-19 outbreak. Settlement agencies have been in operation during the pandemic as they are an essential business but many of them have had to readjust their typical settlement procedures to ensure the safety of their staff and clients.

New Practices Under Virginia's Stay-at-Home Order

Certain procedures will vary between title agencies as each company decides what is best for their office. West View Title Agency has temporarily closed the office to the public and is handling closings over the phone while the seller or purchaser signs the documents from their car or a table in the parking lot, still within sight of a processor who can notarize the documents. According to Stewart Title’s website, they are limiting who attends closings, disinfecting between all clients, and maintaining 6 feet of distance (in addition to other safety precautions). Other agencies may require you wear a mask at closing or email photocopies of your driver’s license prior to settlement. If you aren’t sure what your own settlement agency’s policies are, a quick call can help you prepare for a contact-less/ limited-contact closing.

Closing in the Future as the State Slowly Re-opens

While the new practices for closing are not ideal, they are in place to prevent coronavirus from spreading. Setting aside the health ramifications, it’s important to keep in mind that if one employee gets sick at a title agency (particularly a smaller agency where the employees work closely together), it could require several people in the office to quarantine for two weeks which would slow down transactions. In the case of West View Title Agency, future closings will likely be handled differently than they were pre-pandemic. Buyers and sellers will close separately and only those who are signing documents would be allowed in so social distancing is still observed. Masks will probably be required as well. Regardless of how a title agency decides to operate, preventing the spread of COVID-19 is still up to every individual and we should all continue to follow recommendations from the WHO and CDC.

Whether you are renovating a home to prepare it for sale or just want to improve it, renovations can be expensive so it’s important to find a contractor you trust and ensure your upgrades add value to your house. Renovating a home can seem overwhelming at first, especially if you have several ideas or projects you want to accomplish. If you have any issues with the basics- your roof, HVAC system, plumbing, or flooring and walls- they will be your first priority. If everything is in good working condition, you may decide to focus on the kitchen or bathrooms which typically have a high return on investment. So once you’ve decided on your project, what should you do next?

1. Set a Budget

Your budget may look different if you are improving upon your dream home versus if you plan to sell your home in a few years. Not all upgrades will pay for themselves when it comes to selling a home. However, if you are improving on a home you plan to live in for several years to come, it may make sense to splurge on amenities that you would want regardless of resale value. A big part of the budget is deciding on materials. In most cases, you want to balance your splurges with economic substitutions. You may decide on an upscale laminate over true hardwood floors or choose a cost-effective neutral tile in the bathroom paired with a top-of-the-line tile for an accent strip. After getting some estimates, you may find that you do not have enough saved. It’s a good idea to review loan options and talk with your mortgage lender.

2. Devise a Plan

Get together all the information about your project including everything you want done and desired materials. You may decide to create your own plan or you might meet with a pro, like an architect or interior designer. It’s a good idea to establish early on how involved you want them to be in the process since hiring an architect for the full job (assembling a team of contractors, overseeing construction, designing every aspect of your renovation) could be costly.

3. Create a List of Candidates

Your realtor, friends and family, and social media platforms can be a good springboard for you to start a list of people/ businesses you may want to use for your renovations. You can find more candidates through an online search as well. Then you will want to narrow down the list by looking at reviews carefully.

4. Interview the Best Candidates

Now you can verify with each candidate that they are licensed and insured as well as inquire about their past work with renovations similar to yours. You can request references and then make sure they check out. Next, you should set up in-person interviews. This ensures you will work well with your contractor and they get a chance to see the property/ area you want renovated. This will help them give you an accurate estimate; you may even decide you want to pay for a “hard estimate” at this time to be sure you will stay within budget (which can be particularly important if you plan to sell soon and want the best return on investment).

5. Select a General Contractor

Now you are ready to hire your General Contractor (or plumber, painter, designer, etc). You want to be present but avoid micromanaging since that can slow down the renovations and add unnecessary tension. Since you’ve been thorough in your selection process, you can be confident in your team to produce high quality work. That said, it’s always a good idea to let your GC know how to get in touch with you when you aren’t home if they need a decision on purchase or design. Your freshly upgraded home is now ready to be enjoyed, or perhaps, sold!

Sources:

https://www.zillow.com/blog/home-renovation-team-trust-201009/ https://www.zillow.com/blog/high-price-home-improvements-199539/ https://www.investopedia.com/investing/types-home-renovation-which-ones-boost-value/ https://www.bankrate.com/loans/home-improvement/cheap-fixes-to-boost-the-value-of-your-home/ https://www.washingtonpost.com/lifestyle/home/how-to-set-your-budget-for-a-big-home-improvement-project/2018/03/26/acf2b7cc-2c7f-11e8-b0b0-f706877db618_story.html https://www.remodeling.hw.net/cost-vs-value/2019/

As most people know, Spring can be a great time to list your house. I have found that often buyers who have looked all winter are often ready to make a move on the right house when it comes on the market.

I think this Spring will be particularly good due to continued lack of inventory and historically low interest rates. In other words, the normal lack of inventory due to the slower Winter months only adds the to general inventory problems of today's market and is multiplied by a lot of ready and able buyers with low interest rates! The following are some simple tips for getting your house market-ready in time for the Spring: 1. Declutter and Clean Your Home

Having a clean and organized house will instantly make the rooms look bigger and show off the best features of your home. Buyers appreciate having lots of storage space and with knick-knacks out of the way, the closets and other storage areas will look more spacious. If you aren't ready to purge everything, you can rent a storage space while your house is on the market. Keep your house as clean as possible so it is always ready to show and make a good first impression on potential buyers.

2. Make Updates and Repairs

Now would be a good time to review the Pre-Home Inspection Checklist to see what updates your house may need. Be sure to fix leaky faucets, running toilets, squeaky doors, etc. Painting neutral colors and replacing hardware, particularly in the kitchen, are relatively quick upgrades that can impress potential buyers.

3. De-Personalize Your Home

Decluttering your home and painting neutral colors are both important aspects to creating a blank slate so that buyers can easily envision themselves living in your house. Put away most framed photos, toys, personal keepsakes and similar items.

4. Stage Your Home

There are several advantages to staging your house; buyers view the house as well maintained and the furniture placement will help highlight the strengths of your house while minimizing any flaws there may be. This will also maximize the space and make the house look inviting. Staging a home includes the exterior to improve its curb appeal. Fresh paint, a mowed lawn, and landscaping will all ensure a great first impression before potential buyers even enter your home. Contact me if you would like to have a professional stager and myself tour your home and provide consultation and possibly pieces to complement your home.

5. Prepare for Professional Photography

The majority of potential buyers will see photos of your house online before they see it in person. In fact, bad photos could discourage them from seeing your house at all! The first step to taking flattering photos is to maximize both artificial and natural light in your home. Clean windows, replace burned out bulbs and add more lighting fixtures or stand alone lamps to make the house look bright and cheery. Professional photography will put your houses' best foot forward by ensuring the pictures are; clear, crisp, high resolution and taken from the best angles. Tips on preparing your house for pictures can be found here.

6. Pricing Your House

Your listing agent is an invaluable asset to you as you prepare to put your house on the market; they provide a wealth of knowledge regarding the local housing market and determining the value of a home. It's important that the asking price be competitive; if it's too high, your listing may get overlooked and after sitting on the market, buyers may wonder why the house hasn't sold. If you want to discuss your the market value of your house email me here.

As discussed in previous posts, you can sell your home at any point you want to after purchasing it, however it may not be the wisest choice financially. While it typically takes about 2 years for a homeowner to be able to turn around and sell their home without a loss, in some circumstances you may need to sell earlier. In our last post we discussed all the specific aspects of selling a home early that you need to consider in your decision. This includes the following:

Next, we’ll walk through a specific example of how to calculate your profit or loss from selling a home after living in it for six months. Let’s say you purchased a home for $300,000 in July, 2019 and you need to sell now. This is how you would calculate your profit or loss. Home price: $300,000 in July, 2019 Home owned: 6 months Down payment: 20%, or $60,000 Closing costs: 3%, or $9,000 Financing: $240,000 at a 4.5% interest rate, 30-year fixed loan for a monthly payment of $1,586 Equity: $2,000 from paying down principal Closing costs for resale: $20,000 Loss: Total loss equals $29,000 (combined closing costs) plus $2,000 in equity equals a $27,000 net loss So, based on these figures, you would need to sell your home for $327,000 to break even. These calculations don’t include interest payments, property taxes, or insurance, because it’s probable that you would have incurred similar expenses if you had rented instead of buying and reselling. Now, if you find yourself in a situation where you need to sell your home early, such as a job change and relocation or a health emergency, you will be able to be prepared for the expenses you could incur. Preparation will make the whole process less stressful and more manageable. Source: https://www.zillow.com/sellers-guide/how-soon-can-i-sell-my-house-after-purchase/ https://www.realtor.com/advice/sell/how-soon-can-you-sell-a-house-after-buying/

In my last post on buying and selling a home at the same time, we looked at some scenarios in which it’s best to sell your existing home first and then buy your new home. But there are also scenarios in which it’s advantageous to buy first and then sell.

Buying First

Let’s look at two examples of scenarios in which it can be better to buy first, and some steps to take to help you plan it all out.

Available Funding

If you have the funds available to buy a new home before selling your old home, you should take advantage of this fortuitous situation. There are several reasons why it’s a good idea to buy first in the event that you can manage it. Buying first can be the least stressful way to move for a few reasons:

Steps to Follow

Identify and liquidate your assets to be able to make a good offer, also have documentation that you have the funds available

Moving From a Hot Market To a Slow Market

In this scenario it makes sense to buy first because it will be easy to get an offer accepted in the slow market and easy to sell quickly in the hot market. This can happen in Harrisonburg/Rockingham when moving from houses at the median sales price to more expensive neighborhoods. Statistically, there are less people competing the further away you get from the median sales price.

People can shy away from this option because you will be hold two mortgages for a period of time. Some clients are more comfortable with this than others. If you are considering this as an option I would be happy to meet and discuss timing this move. Each situation is unique. Depending on your desire to move slowly, clean, and stage we can get the property marketed quickly. Since I do my own marketing, I can typically be flexible to get the house on the market in a timely manner after it is ready. Pricing plays a larger role in how quickly the property will sell once it hits the market. However, in a hot market, good marketing and correct pricing can result in a quick contract. The contract can then likely be negotiated for a 30 day settlement. So, it is possible for you to only hold the two mortgages for two months. We of course would want to be prepared for unexpected circumstances and be okay with it potentially taking a little longer. For homeowners who don’t want to worry about having two mortgages at the same time, there’s another option, which is making a contingency offer. This can be a nice safety net if you really do not want to hold two mortgages for any given amount of time. Some sellers may not be willing to enter into this type of contract but it is not completely uncommon in a sellers market. Steps to Follow

Pros and Cons

Although it can require more cash on hand, for many homeowners there are still some situations in which it’s better to buy first and then sell later. Here is a look at some pros and cons of buying before selling.

Pros to Buying First

Cons to Buying First

Feeling pressure to sell quickly may cause you to take a lower offer than you would otherwise

Now you have the case for buying before selling, as well as the case for selling first, which we laid out in our previous post. There’s no one right decision, as it depends on your unique situation. So weigh the pros and cons, and go with your gut instinct.

In our last post we introduced some strategies for buying and selling a house at the same time.

But the question still remains, which should you do first, buy or sell? Whether it’s best to buy or sell first will depend on the particular situation you’re in, with variables such as the timeline in which you need to move, the market you’re buying in and the market you’re selling in. In this post we’ll explore why it can be best to sell first, looking at specific scenarios and tips for selling first. Selling First

Here are two sample scenarios in which it would be better to sell your home first, and some steps to follow for making it all work out.

Sellers Market

In this scenario it may take up to a year to find a new home. Rather than stressing over getting the timing of buying and selling just right, sell first and plan to rent until you find your perfect home. That way you have no particular deadline for buying and can wait until you find just the right place to buy. In a hot market selling first is important because making an offer contingent on selling your current house can put you at a disadvantage to other buyers.

Steps to Follow

Relocation

This is actually a very common scenario, and most people in this situation need the money from the sale of their current home to be able to buy in a new city.

It may be best to rent for a few months in the new location to help you get familiar with the new area. It can also help to have a local agent help guide you. If you are planning such a move, I'd be happy to connect you with a qualified agent in your destination city across the country. Shoot me an email. Steps to Follow

Pros and Cons

However you choose to go about selling your current home and moving into a new one, there are some pros and cons to consider for selling first and buying later. Here are a few of them.

Pros to Selling First

Cons to Selling First

Here you have a case for selling first, but there are scenarios in which it may be better to buy first. We'll explore buying first in our next post! |

Categories

All

|

Email - Click Here

Phone - 540-246-9067 Website - www.mattiasclymer.com Schedule a Meeting, Download Contact Card, Etc... |

Funkhouser Real Estate Group | 401 University Boulevard, Harrisonburg, VA 22801 | 540-434-2400 | ©2021 | Privacy Policy | All rights reserved.

Licensed in the Commonwealth of Virginia

RSS Feed

RSS Feed