|

The 1031 tax exchange had earned it's name rather unimaginatively: it comes from tax code. This section of tax code mostly revolves around investment real estate. The government is providing this opportunity for investors as an incentive to keep investing in real estate.

How does it work? To explain it simply, one could sell their investment property and not pay taxes on the sale by reinvesting the money back into another investment property. This would allow an investor to increase their investments. Traditionally, these exchanges were allowed so that two owners could exchange their properties tax free. However, the odds of someone finding a perfect trade are slim. Therefore, most people execute a delayed exchange. This means that a third party would hold onto the funds received from selling a property until another property is acquired. Important:

Please let me know if you have any questions by leaving a comment below.

0 Comments

If you haven't filed your taxes, now would be a good time. Even if you have filed them, it's a good to know what deductibles are possible to claim as a homeowner.

The following is one part of a three part series I did on real estate tax. Click here to explore The 3 D's of Real Estate Tax. The first D of real estate tax is Deductible. For more information, or advice, contact a CPA or tax attorney. 1. Mortgage Interest- The interest paid on a balance of up to 1 million dollars can be deducted. 2. Private Mortgage Insurance- If a homeowner pays PMI, it can be a deduction. 3. Home Improvement Loan interest- The interest on $100,000 and lower loans can be deducted. 4. Mortgage Points- An origination fee or mortgage points that a homeowner paid to obtain a better interest rate can be deducted. 5. Energy Efficiency Upgrades- The cost of energy saving materials can be deducted directly from your taxes instead of your taxable income. 6. Real Estate Profit- The profit of a real estate sale can be claimed as tax free. Individuals can claim up to $250,000 and married couples can claim up to $500,000. 7. Real Estate Selling Cost- Any profit exceeding the aforementioned maximums are taxable. However, you can add up fees paid at closing, the cost of improvements, marketing costs of selling your home, etc... 8. Home Office- Having a home office is deductible. The room must be solely used as an office and it must be the primary location you get your work done. Each SqFt is a $5 deduction, up to 300 sq ft. 9. Property Tax- As confusing as it sounds, you can actually deduct your property tax. Effectively, property tax is different than income tax and you can write off the property tax to reduce your taxable income. 10. Loan Forgiveness- The Mortgage Debt Forgiveness Relief Act of 2007 allows the forgiven debt after a short sale that took place between 2007 and 2013 to be tax free. In other words, if you sold your home in a short sale process and got $50,000 but owed $75,000 and the bank forgave you the $25,000. The government views that $25,000 as taxable income. The aforementioned act forgives the tax on the $25,000. 11. Depreciation- Click here for more information. Here you will find an overview of deductibles you can use in relation to Real Estate. For more information, or advice, contact a CPA or tax attorney.

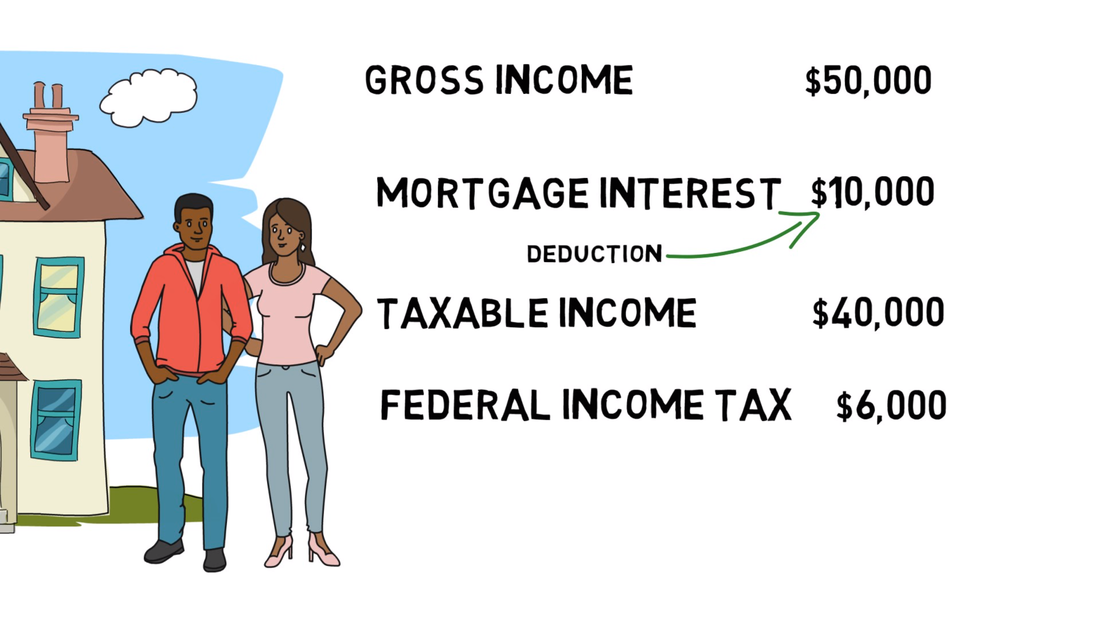

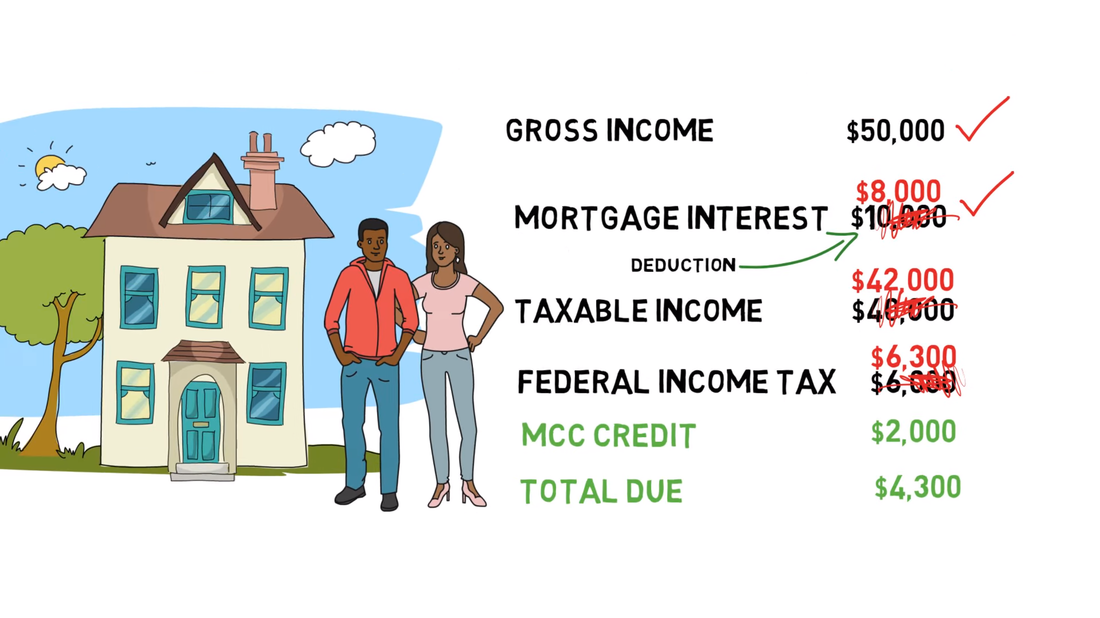

Click here to return to The 3 D's of Real Estate Tax. 1. Mortgage Interest- The interest paid on a balance of up to 1 million dollars can be deducted. 2. Private Mortgage Insurance- If a homeowner pays PMI, it can be a deduction. 3. Home Improvement Loan interest- The interest on $100,000 and lower loans can be deducted. 4. Mortgage Points- An origination fee or mortgage points that a homeowner paid to obtain a better interest rate can be deducted. 5. Energy Efficiency Upgrades- The cost of energy saving materials can be deducted directly from your taxes instead of your taxable income. 6. Real Estate Profit- The profit of a real estate sale can be claimed as tax free. Individuals can claim up to $250,000 and married couples can claim up to $500,000. 7. Real Estate Selling Cost- Any profit exceeding the aforementioned maximums are taxable. However, you can add up fees paid at closing, the cost of improvements, marketing costs of selling your home, etc... 8. Home Office- Having a home office is deductible. The room must be solely used as an office and it must be the primary location you get your work done. Each SqFt is a $5 deduction, up to 300 sq ft. 9. Property Tax- As confusing as it sounds, you can actually deduct your property tax. Effectively, property tax is different than income tax and you can write off the property tax to reduce your taxable income. 10. Loan Forgiveness- The Mortgage Debt Forgiveness Relief Act of 2007 allows the forgiven debt after a short sale that took place between 2007 and 2013 to be tax free. In other words, if you sold your home in a short sale process and got $50,000 but owed $75,000 and the bank forgave you the $25,000. The government views that $25,000 as taxable income. The aforementioned act forgives the tax on the $25,000. 11. Depreciation- Click here for more information. If you are a first time homeowner, or not owned a home as your primary residence for the past 3 years, you could be able to benefit significantly from a VHDA Mortgage Credit Certificate (MCC). How much? It's actually significant. Most people will take the interest they pay on their mortgage and deduct that from their taxable income. So, they wont pay taxes on the money earned that went to the mortgage interest. These savings depend on the tax bracket you are in. The MCC credit will let you take 20% of the interest you pay off of your total tax bill. You are then able to deduct the rest of the interest in the normal way. The video below spells out the savings pretty well. If you don't want to watch it, here are some screen shots that will explain the savings. This is what the normal deduction would look like. They are simply reducing their gross income by the interest they paid on their mortgage. This leaves them owing $6,000 in tax. Now lets look at how their taxes would look like with an MCC credit. Here we can see that their income and mortgage interest are still the same. However, they are only able to reduce their taxable income by 80% of the mortgage interest they paid because the other 20% is being applied through the MCC credit. As you can see, the total taxes they owe are $1,700 less with the MCC. If you are interested, be sure to watch the video below. Also check out VHDA's website for more information: In general, it's a good idea to keep receipts for improvements on your home. With those receipts, you can determine the best tax plan with your accountant.

If you happened to replace some windows or exterior doors in 2015, you may be entitled to a tax credit. -For doors, you can get up to a $500 credit. -For windows, you can get up to a $200 credit total but not per window. Unfortunately, installation costs aren't considered. Combined, you can claim 10% of all expenditures with the limit to $500 for all energy improvements combined. The IRS form 5695 Overall, it's a good idea to hire an accountant to handle ensure you are filing your taxes correctly. They will likely help you find deductions that you didn't know about and protect you from audits. Source This is part three of a series. Click here to go back to "An Overview of the Three D's of Real Estate Tax"

Being able to defer paying taxes and instead use your profits to reinvest into real estate is one of an investors favorite tools. This deferment is available because the government is in favor of people investing in real estate. 1031 Exchange One of the most popular exchanges is the 1031 exchange. This allows you to sell a piece of real estate and reinvest all of the earned money into another property without paying taxes. For more information, click here. Roll Over an IRA The IRS allows you to roll over your IRAs into investment real estate. This could be a great way to diversify your portfolio. You could reinvest the cash flow you get from the property or use it for extra income. You would need to speak with an accountant and financial planner to get a better understanding of the limitations and potential. Click here to go back to An Overview of the Three D's of Real Estate Tax.

The IRS understands that overtime, your house costs money to maintain. They allow you to deduct money from your taxes to account for the costs of a depreciating house. The great thing is that all interest in Real Estate know that it generally goes up in value over a long enough period of time. So, while your investment goes up in value, you are still able to deduct from your taxes it's depreciation. If this article sparks your interest, I would recommend going straight to the IRS to get more information. Here is what you'll need to know. |

Categories

All

|

Email - Click Here

Phone - 540-246-9067 Website - www.mattiasclymer.com Schedule a Meeting, Download Contact Card, Etc... |

Funkhouser Real Estate Group | 401 University Boulevard, Harrisonburg, VA 22801 | 540-434-2400 | ©2021 | Privacy Policy | All rights reserved.

Licensed in the Commonwealth of Virginia

RSS Feed

RSS Feed