|

Cash-on-Cash Return is what you would use to compare your investment to other types of investments, like stocks. To calculate Cash-on-Cash Return, take the Annual Cash flow and divide it by the Down Payment amount. Annual Cash Flow Down Payment Lets see it with an example from Camden Towns.

Investment Anaylisis from HarrisonburgInvestmentProperties.com

This is a continuation of a serious entitled: The Top 10 Terms of Commercial/Investment Real Estate.

0 Comments

Most buy and hold real estate investors agree that cash flow is the ultimate goal. To calculate cash flow, you take the NOI and subtract it by the Debt Service. NOI - Debt Service = Annual Cash Flow See how the cash flow is calculated for Pheasant Run in Harrisonburg. Click here for available properties. This is a continuation of a serious entitled: The Top 10 Terms of Commercial/Investment Real Estate.

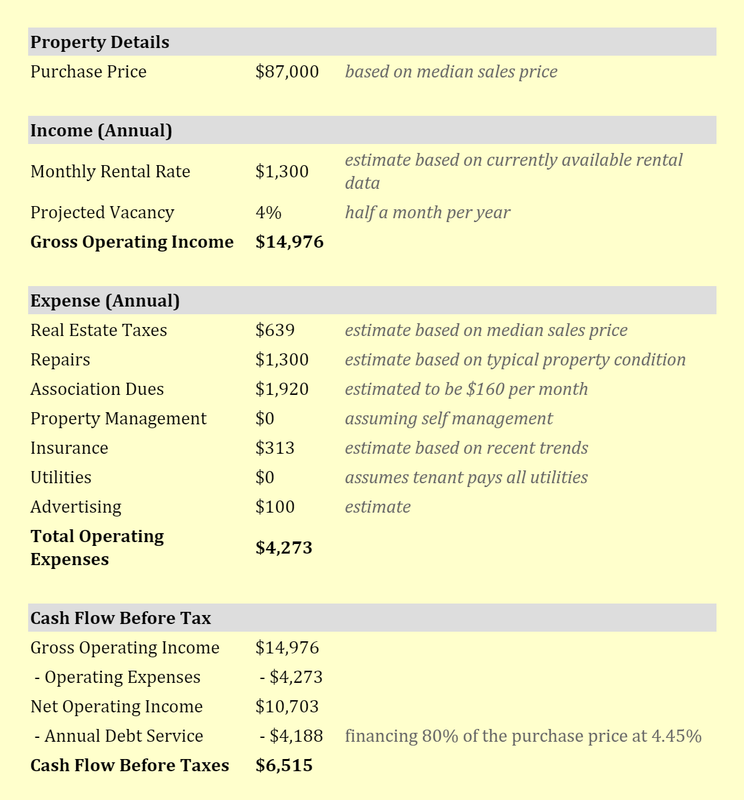

Cash Flow Calculations Source: http://www.harrisonburginvestmentproperties.com/pheasant-run/ Debt service is simply the mortgage payment associated with a property. This can be annualized by multiplying one payment by 12.

If you are considering purchasing a property that has a NOI of $60,000. To better understand what your cash flow will look at, you will want to subtract your debt service from the NOI. Example Property 1 NOI: $60,000 Monthly Mortgage Payment: ($896 x 12) Debt Service - $10,752 Cash Flow $49,248 This is a continuation of a serious entitled: The Top 10 Terms of Commercial/Investment Real Estate. The net operating income is the income minus the expenses excluding the mortgage. The NOI is used to help determine the profitability and value of a property. So, the NOI is effectively what the property would be making a person who buys in cash. Here's an example.

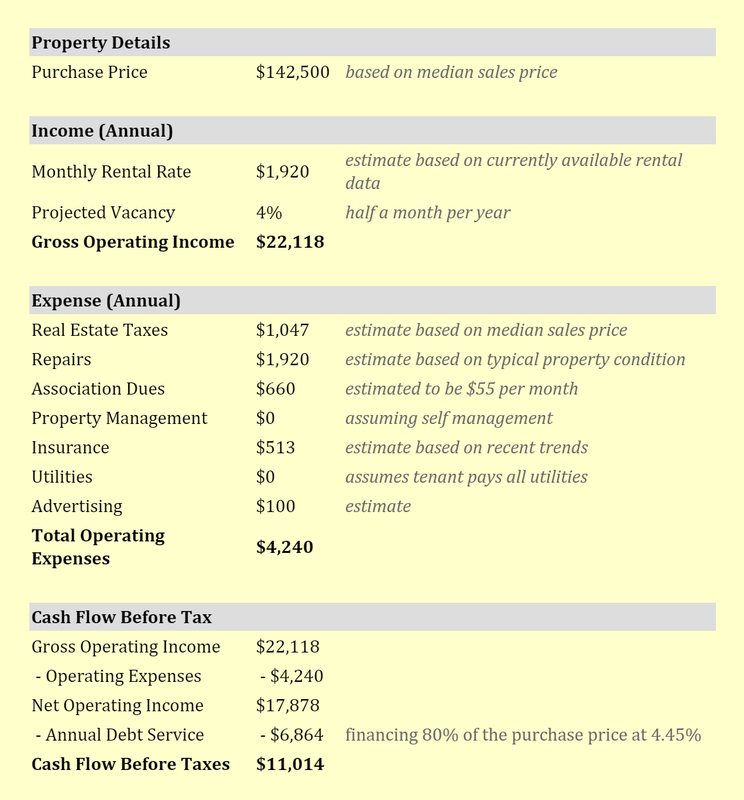

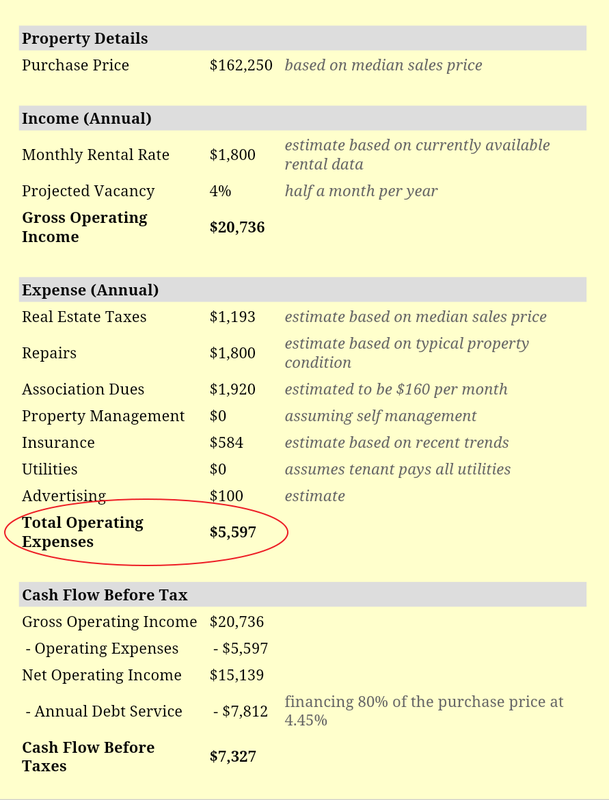

Annual Income: $100,000 - Annual Operating Expenses: $45,000 __________________________________________________ Net Operating Income (NOI): $55,000 The NOI is important if you are thinking about purchasing a property. It will not only give you a sense of what you will be earning but it will also help the bank determine if you can afford the mortgage payments. If you own the property, it's a helpful tool to help determine the value of your asset. Furthermore, you can look to increase the value by increasing the NOI. This is a continuation of a serious entitled: The Top 10 Terms of Commercial/Investment Real Estate. Operating Expenses are what it costs to run a business. Some examples of operating expenses include: taxes, insurance, utilities, management fees, landscaping, maintenance, repairs, and advertising. The following is what buying a Campus View Condo may look like. The expense sheet is from HarrisonburgInvestments.com This is a continuation of a serious entitled: The Top 10 Terms of Commercial/Investment Real Estate.

Effective Gross income is also known as EGI. This number is one of the first things you will want to look at when determining a property's income potential. This will be a key figure in determining the Net Operating Income.

Keep in mind that you can add other income sources such as parking, vending machines, laundry, etc... The following is an example of calculating EGI: Gross Income – Vacancy Costs (vacancy rate (%) x income = $ amount) – Credit Loss (i.e. collections, evictions, etc) = Effective Gross Income (EGI) For example, using the same property information above: Gross Income: $120,000 (minus)Vacancy Rate (20%): $24,000 (minus) Credit Loss (2%): $2400 (plus) Additional Miscellaneous Income (Laundry, Parking, etc.): $3500 =Effective Gross Income (EGI): $97,100 This is a continuation of a serious entitled: The Top 10 Terms of Commercial/Investment Real Estate. Example Source: Biggerpockets.com Vacancy rate is the percentage of vacant units in comparison to all the units in the property.

Vacancies Total Units An example would be if a hundred unit property had 5 vacancies, the property would have a 5% vacancy rate. As mentioned in the Vacancy blog, one could purchase a property at a discount, due to a high vacancy rate, solve the reason for the vacancy, fill the vacant units, and then have a more valuable property. This is a continuation of a serious entitled: The Top 10 Terms of Commercial/Investment Real Estate. Gross income is the total amount of income you can get in a property. This is important to understand because this number isn't necessarily guaranteed. For example, if a property has 4 units that rent for $500 a month, the gross income would be $2,000 a month. However, this property may only be partially rented.

Having a property only partially rented could be a bonus if the purchase price reflects the occupancy status. In other words, if you buy the property and make do what it takes to make it fully rented, you can increase the value of the property quickly. In addition to rent, other items such as coin operated laundry, storage fees, late fees, vending machines, etc, can be factored into gross income. Top Ten Terms for Commercial and Investment Real Estate Capitalization rate, commonly known as Cap Rate, is the Net Operating Income divided by the sales price. The Cap Rate tells you how well your invest performs if you bought the property in cash. This number is frequently used in commercial and investment real estate to determine the value and profitability of a property. To find the cap rate, you divide the NOI by the sales price.

NOI Sales Price Let's pull the example used in the NOI blog post and figure out what you would need to pay for a property that has a NOI of $55,000 to get a 10% cap rate. 55,000 = 550,000 .1 So, we'd need to purchase an investment property, with a NOI of $55,000 at $550,000 to get a 10% cap rate. Let's double check our math. 55,000 = .1 or 10% 550,000 This is the last post of a serious entitled: The Top 10 Terms of Commercial/Investment Real Estate. Welcome to the list of the top 10 terms used in commercial/investment real estate. If you are thinking of getting into investing and/or commercial real estate. It will help to familiarize yourself with these terms as they are used frequently in the field.

The following is a summary. Click on the terms to get examples and more detailed definitions. 1. Gross Income $ Gross income is all of the income that you make on a property. This includes rent, laundry, storage fees, late fees, vending machines, etc. 2. Vacancy $ Any unit that is not occupied and not producing income is considered a Vacancy. Keep in mind that if a unit changes tenants in the same month, it is considered a turnover, not a vacancy. 3. Vacancy Rate % This is the number of vacancies divided by the total number of units. Vacancies Total Units 4. Effective Gross Income $ Effective gross income is a number that takes into account what you will be making with vacancies. Income - (Vacancy Rate (%) x Income) = Effective Gross Income 5. Operating Expenses $ The total annual expenses of an investment; including taxes, insurance, utilities, management fees, landscaping, maintenance, repairs, and advertising. 6. Net Operating Income (NOI) $ To get the NOI, take the Gross Income and subtract it by the Operating Expenses. Effective Gross Income - Operating Expenses = NOI 7. Debt Service $ Debt Service is the annual cost of your mortgage. Monthly Mortgage Amount x 12 = Debt Service 8. Cash Flow $ Most buy and hold real estate investors agree that cash flow is the ultimate goal. To calculate cash flow, you take the NOI and subtract it by the Debt Service. NOI - Debt Service = Annual Cash Flow 9. Cash-on-Cash Return % Cash-on-Cash Return is what you would use to compare your investment to other types of investments, like stocks. To calculate Cash-on-Cash Return, take the Annual Cash flow and divide it by the Down Payment amount. Annual Cash Flow Down Payment 10. Capitalization Rate % AKA Cap Rate, shows how well the investment performs if you pay all cash. To calculate a Cap Rate, you take the Net Operating Income and divide it by the Sales Price. NOI Sales Price Source: Commercial Real Estate for Beginners: The Basics of Commercial Real Estate Investing. By Peter Harris |

Categories

All

|

Email - Click Here

Phone - 540-246-9067 Website - www.mattiasclymer.com Schedule a Meeting, Download Contact Card, Etc... |

Funkhouser Real Estate Group | 401 University Boulevard, Harrisonburg, VA 22801 | 540-434-2400 | ©2021 | Privacy Policy | All rights reserved.

Licensed in the Commonwealth of Virginia

RSS Feed

RSS Feed