Profiting in a Competitive Real Estate Market

This month we had Nhan Lam guest speaking on: How to Profit in a Competitive Real Estate Market. Nhan is a true entrepreneur who owns and operates several successful businesses. As the son of a family who escaped communist Vietnam in the 1970s, he was conditioned to never be complacent. His parents taught him to never take the freedoms we have in America for granted and that he should always give his best in everything he does. He has a Master’s Degree in Aerospace Engineering, and he achieved great success in Corporate America. However, despite his high salary, he knew that his job would not help him achieve the goals that he desired, which were to retire his parents, be a stay-at-home parent, and have the true freedoms that were meant for every American (the freedom of choice).

He continually sought out business opportunities in his spare time and became successful in several of them on a part-time basis but realize that his passion was in real estate. In 2011, he decided to attend a Real Estate Rehabbing Bootcamp. From there, he applied what he learned to building a sustainable real estate business while he was still working on his full-time job. Within 2 years, he replaced his full-time income and left his job. He is a father to 5 children and the thing that he enjoys the most is his ability to be flexible to the needs of his family. Since going full time, he averages 12 to 15 deals per year which includes Rehabs, Wholesales, and Rentals and has also started a Real Estate Investing Education company to help students get started. As of 2022, he has trained almost 1,000 students face to face or virtually through his bootcamp trainings and mentoring programs and is proud to say that the success rate of his students are well above industry average. He contributes this success to his commitment to provide a customized business plan for students based on the skills they have today and not commit them to long-term learning that may lead to nowhere. He believes that the measure of success is not by how much money you make, but instead by how many people you have helped along the way to achieve the same success. Watch the Recorded Meetup HereWhat is the Harrisonburg Investors Network?

The Harrisonburg Real Estate Investors network is a group of experienced investors, agents, lenders, attorneys, insurance brokers, contractors, and real estate newbies looking to grow their business. They focus on real estate investing ranging from residential to multifamily investments and active to passive real estate investing. Their goal is to establish a community of real estate professionals, both amateur and experienced, that creates the network and environment to grow everyone’s business. Check out their Facebook page or join their Meetup group to get more information about upcoming meetings!

1 Comment

Private and Hard Money Lending with Rob Iten

This month we had Rob Iten with Anchorbolt Lending, LLC guest speaking on his business which specializes in private and hard money lending for real estate!

Rob Iten has been active in private lending since 2015. His company, Anchorbolt Lending LLC, is a direct private lender focusing primarily on providing short-term acquisition and renovation financing for deals in Virginia, Maryland, Washington, DC, and Florida. In his nearly 20 years in real estate, Rob has renovated nearly 400 homes, developed dozens of subdivisions, and owned and operated self-storages and mobile home parks. Play the video recording (below) of Rob as he discussed his experience in the lending space and what you, as an investor, need to do in order to secure private or hard money loans. What is the Harrisonburg Real Estate Investor Network?

The Harrisonburg Real Estate Investors network is a group of experienced investors, agents, lenders, attorneys, insurance brokers, contractors, and real estate newbies looking to grow their business. They focus on real estate investing ranging from residential to multifamily investments and active to passive real estate investing. Their goal is to establish a community of real estate professionals, both amateur and experienced, that creates the network and environment to grow everyone’s business. Check out their Facebook page or join their Meetup group to get more information about upcoming meetings!

October's Meetup

This month, Chase Louderback & Mattias Clymer covered how to invest in rental property. Whether you are a new real estate investor or seasoned landlord, you will benefit from learning the different strategies to build, and compound, your long-term wealth. If you weren't able to join Harrisonburg REI's virtual meetup, check out the recorded meeting below to learn how some investors are still finding rental real estate deals in a HOT market!

What is the Harrisonburg Real Estate Investor Network?

The Harrisonburg Real Estate Investors network is a group of experienced investors, agents, lenders, attorneys, insurance brokers, contractors, and real estate newbies looking to grow their business. They focus on real estate investing ranging from residential to multifamily investments and active to passive real estate investing. Their goal is to establish a community of real estate professionals, both amateur and experienced, that creates the network and environment to grow everyone’s business. Check out their Facebook page or join their Meetup group to get more information about upcoming meetings!

Harrisonburg REI September Meeting

Last week, Harrisonburg Real Estate Investor Network hosted a virtual meeting to review all the ins and outs of renovating a flip. Chase Louderback discussed some strategies to help estimate costs, mitigate risks, and how to look for potential “deal killers.” If you didn't get a chance to join the meeting, check out the video below!

What is the Harrisonburg Real Estate Investor Network?

The Harrisonburg Real Estate Investors network is a group of experienced investors, agents, lenders, attorneys, insurance brokers, contractors, and real estate newbies looking to grow their business. They focus on real estate investing ranging from residential to multifamily investments and active to passive real estate investing. Their goal is to establish a community of real estate professionals, both amateur and experienced, that creates the network and environment to grow everyone’s business. Check out their Facebook page or join their Meetup group to get more information about upcoming meetings!

Analyzing Multi-Family Properties with Cassidy Burns

We will be having our first in-person meeting again in over a year! Guest speaker Cassidy Burns, Real Estate Agent and Investor, will discuss and analyze a 17-unit Apartment Complex that he acquired during the COVID pandemic. He will evaluate CAP rates, how he located the deal, raised the money from an equity position, and what his future plans are for this deal. After recently starting a satellite team in the Shenandoah Valley to increase his Multi-Family acquisition deal flow, he is poised to take on an additional 150 units by the end of 2021. He is targeting 50-150 unit buildings built between 1970 and 2005 in the Shenandoah Valley region. Join us to learn more about multi family real estate investing and long term wealth generation tonight at 6 pm at the Harrisonburg Real Estate Investors Meet-Up.

Meeting Starts at 6pm Tonight

Come join us in person as we discuss multifamily and network with other local real estate investors! Please enter from the rear of the Funkhouser Real Estate Group building in Harrisonburg. Meetup sign will be on the door. We can't wait to see you!

What is the Harrisonburg Real Estate Investor Network?

The Harrisonburg Real Estate Investors network is a group of experienced investors, agents, lenders, attorneys, insurance brokers, contractors, and real estate newbies looking to grow their business. They focus on real estate investing ranging from residential to multifamily investments and active to passive real estate investing. Their goal is to establish a community of real estate professionals, both amateur and experienced, that creates the network and environment to grow everyone’s business. Check out their Facebook page or join their Meetup group to get more information about upcoming meetings!

Diving into Real Estate Investing

I am excited to announce that Chase and I will be reviewing the full process on how to buy your first, or next, investment property! This topic will be broken up into two parts to give a full, in-depth guidance on closing an investment property.

Tonight we will cover Part 1:

Tonight's Meeting Starts at 6:00 PM

Whether you are a complete newbie or experienced investor, we are sure you will learn new tips and resources to help with your current investment process as we take a deep dive into investing in the local real estate markets! Join us live at 6:00 pm on the Harrisonburg REI website.

Can't make the meeting? We have recordings of all our previous meetings on the website as well. What is the Harrisonburg Real Estate Investor Network?

The Harrisonburg Real Estate Investors network is a group of experienced investors, agents, lenders, attorneys, insurance brokers, contractors, and real estate newbies looking to grow their business. They focus on real estate investing ranging from residential to multifamily investments and active to passive real estate investing. Their goal is to establish a community of real estate professionals, both amateur and experienced, that creates the network and environment to grow everyone’s business. Check out their Facebook page or join their Meetup group to get more information about upcoming meetings!

A little bit about my real estate background...

I got my license in 2014 and since then I have had the honor of being named a Top Agent by Virginia Living Magazine, a Top Agent in America and in the top 5% of local agents in production and negotiation by HomeLight. In addition to sales, I am passionate about micro loans and created a local KIVA team that provides loans to those who could not otherwise get financing. My passion for real estate investing eventually led me to start an investment club in 2017. I later joined forces with Chase Louderback to create the investors club we have today.

Join us tonight from 6-8pm

I have not only sold short term rentals to clients but also taken a deep dive into understanding how to create successful short term rental business locally. Tonight I will be discussing how I analyze a property to see if it makes sense as a short-term rental as I dissect a previously listed short term rental that was for sale.

Join the meeting here. About Harrisonburg Real Estate Investors Network

The Harrisonburg Real Estate Investors network is a group of experienced investors, agents, lenders, attorneys, insurance brokers, contractors, and real estate newbies looking to grow their business. They focus on real estate investing ranging from residential to multifamily investments and active to passive real estate investing. Their goal is to establish a community of real estate professionals, both amateur and experienced, that creates the network and environment to grow everyone’s business. Check out their Facebook page or join their Meetup group to get more information about upcoming meetings!

Who is Evan Mayo?

Evan Mayo is a trial attorney and real estate investor located in Charlottesville, Virginia. He began investing in real estate in Charlottesville in 2017 and has a personal portfolio in Charlottesville, Virginia and Harrisonburg. He also works in a real estate partnership based in Chattanooga, Tennessee that raised over 1MM in private capital to purchase 30 units in the past eighteen months. Evan’s law practice focuses on personal injury, defamation, and construction litigation cases. He also advises on real estate tax matters including self-directed IRAs and 401ks. His primary real estate interests are creative financing and the use of equity and debt instruments to permit small and medium-scale real estate investors to continue growing beyond their personal means.

Join us tonight at 6pm

Join us for a conversation with Evan Mayo about techniques for fundraising and using partnership structures to accelerate real estate growth. Evan will share the different structures he has used in partnerships in Tennessee and Virginia to accumulate small multifamily properties over the past two years. He will include tax treatment of these different structures, creative methods to compensate wholesalers, contractors, and silent partners, including collateralization, shared appreciation notes, and an introduction to options as security concepts. There will be a Q&A period following the presentation.

About Harrisonburg Real Estate Investors Network

The Harrisonburg Real Estate Investors network is a group of experienced investors, agents, lenders, attorneys, insurance brokers, contractors, and real estate newbies looking to grow their business. They focus on real estate investing ranging from residential to multifamily investments and active to passive real estate investing. Their goal is to establish a community of real estate professionals, both amateur and experienced, that creates the network and environment to grow everyone’s business. Check out their Facebook page or join their Meetup group to get more information about upcoming meetings!

The 1031 tax exchange had earned it's name rather unimaginatively: it comes from tax code. This section of tax code mostly revolves around investment real estate. The government is providing this opportunity for investors as an incentive to keep investing in real estate.

How does it work? To explain it simply, one could sell their investment property and not pay taxes on the sale by reinvesting the money back into another investment property. This would allow an investor to increase their investments. Traditionally, these exchanges were allowed so that two owners could exchange their properties tax free. However, the odds of someone finding a perfect trade are slim. Therefore, most people execute a delayed exchange. This means that a third party would hold onto the funds received from selling a property until another property is acquired. Important:

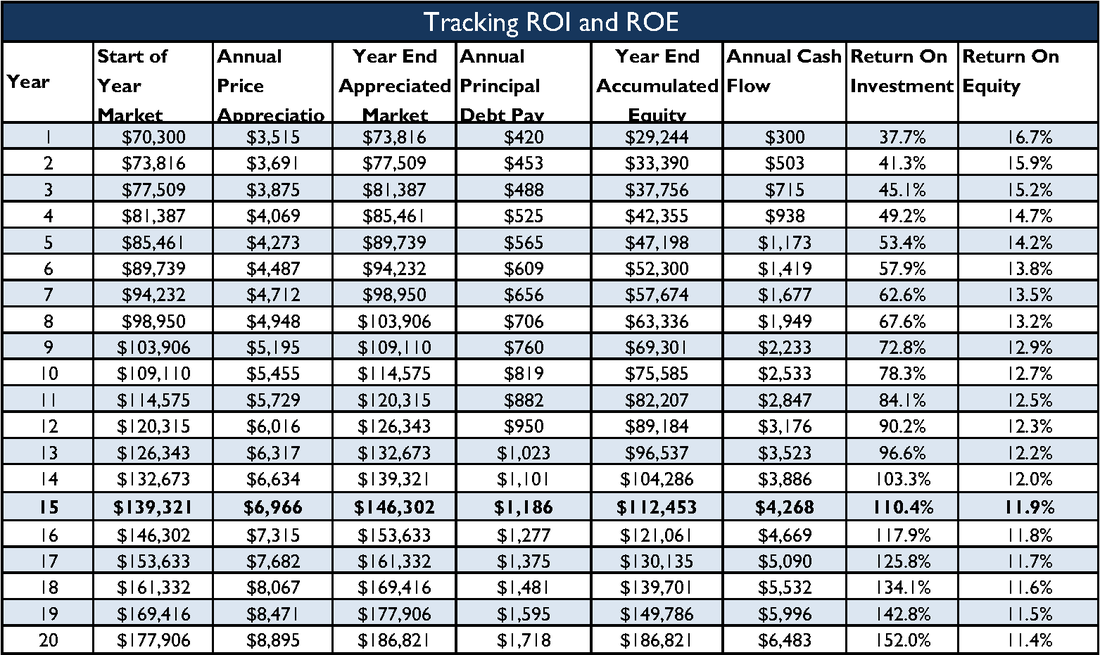

Please let me know if you have any questions by leaving a comment below. Why do real estate investors leverage their investment properties? The most obvious answer is that the more they leverage, the more properties they can purchase. If purchased correctly, each property should generate positive cash flow. Not only do the investors get more monthly cash flow with more properties, but they also have more renters paying down more mortgages creating more equity. Another reason investors leverage their money is because of the Return on Equity (ROE). The ROE is calculated by dividing the total annual return by the equity. As you can see in the chart below, your ROE goes down as your equity goes up. This is why some investors choose to pull their equity out of existing investments and use them to obtain new investments. One word of caution: the more you leverage, the more you risk. Some investors choose to pay their mortgage off and simply receive returns on through cash flow. Chart is from The Millionaire Real Estate Investor

|

Categories

All

|

Email - Click Here

Phone - 540-246-9067 Website - www.mattiasclymer.com Schedule a Meeting, Download Contact Card, Etc... |

Funkhouser Real Estate Group | 401 University Boulevard, Harrisonburg, VA 22801 | 540-434-2400 | ©2021 | Privacy Policy | All rights reserved.

Licensed in the Commonwealth of Virginia

RSS Feed

RSS Feed