Profiting in a Competitive Real Estate Market

This month we had Nhan Lam guest speaking on: How to Profit in a Competitive Real Estate Market. Nhan is a true entrepreneur who owns and operates several successful businesses. As the son of a family who escaped communist Vietnam in the 1970s, he was conditioned to never be complacent. His parents taught him to never take the freedoms we have in America for granted and that he should always give his best in everything he does. He has a Master’s Degree in Aerospace Engineering, and he achieved great success in Corporate America. However, despite his high salary, he knew that his job would not help him achieve the goals that he desired, which were to retire his parents, be a stay-at-home parent, and have the true freedoms that were meant for every American (the freedom of choice).

He continually sought out business opportunities in his spare time and became successful in several of them on a part-time basis but realize that his passion was in real estate. In 2011, he decided to attend a Real Estate Rehabbing Bootcamp. From there, he applied what he learned to building a sustainable real estate business while he was still working on his full-time job. Within 2 years, he replaced his full-time income and left his job. He is a father to 5 children and the thing that he enjoys the most is his ability to be flexible to the needs of his family. Since going full time, he averages 12 to 15 deals per year which includes Rehabs, Wholesales, and Rentals and has also started a Real Estate Investing Education company to help students get started. As of 2022, he has trained almost 1,000 students face to face or virtually through his bootcamp trainings and mentoring programs and is proud to say that the success rate of his students are well above industry average. He contributes this success to his commitment to provide a customized business plan for students based on the skills they have today and not commit them to long-term learning that may lead to nowhere. He believes that the measure of success is not by how much money you make, but instead by how many people you have helped along the way to achieve the same success. Watch the Recorded Meetup HereWhat is the Harrisonburg Investors Network?

The Harrisonburg Real Estate Investors network is a group of experienced investors, agents, lenders, attorneys, insurance brokers, contractors, and real estate newbies looking to grow their business. They focus on real estate investing ranging from residential to multifamily investments and active to passive real estate investing. Their goal is to establish a community of real estate professionals, both amateur and experienced, that creates the network and environment to grow everyone’s business. Check out their Facebook page or join their Meetup group to get more information about upcoming meetings!

1 Comment

Who is Evan Mayo?

Evan Mayo is a trial attorney and real estate investor located in Charlottesville, Virginia. He began investing in real estate in Charlottesville in 2017 and has a personal portfolio in Charlottesville, Virginia and Harrisonburg. He also works in a real estate partnership based in Chattanooga, Tennessee that raised over 1MM in private capital to purchase 30 units in the past eighteen months. Evan’s law practice focuses on personal injury, defamation, and construction litigation cases. He also advises on real estate tax matters including self-directed IRAs and 401ks. His primary real estate interests are creative financing and the use of equity and debt instruments to permit small and medium-scale real estate investors to continue growing beyond their personal means.

Join us tonight at 6pm

Join us for a conversation with Evan Mayo about techniques for fundraising and using partnership structures to accelerate real estate growth. Evan will share the different structures he has used in partnerships in Tennessee and Virginia to accumulate small multifamily properties over the past two years. He will include tax treatment of these different structures, creative methods to compensate wholesalers, contractors, and silent partners, including collateralization, shared appreciation notes, and an introduction to options as security concepts. There will be a Q&A period following the presentation.

About Harrisonburg Real Estate Investors Network

The Harrisonburg Real Estate Investors network is a group of experienced investors, agents, lenders, attorneys, insurance brokers, contractors, and real estate newbies looking to grow their business. They focus on real estate investing ranging from residential to multifamily investments and active to passive real estate investing. Their goal is to establish a community of real estate professionals, both amateur and experienced, that creates the network and environment to grow everyone’s business. Check out their Facebook page or join their Meetup group to get more information about upcoming meetings!

Cash-on-Cash Return is what you would use to compare your investment to other types of investments, like stocks. To calculate Cash-on-Cash Return, take the Annual Cash flow and divide it by the Down Payment amount. Annual Cash Flow Down Payment Lets see it with an example from Camden Towns.

Investment Anaylisis from HarrisonburgInvestmentProperties.com

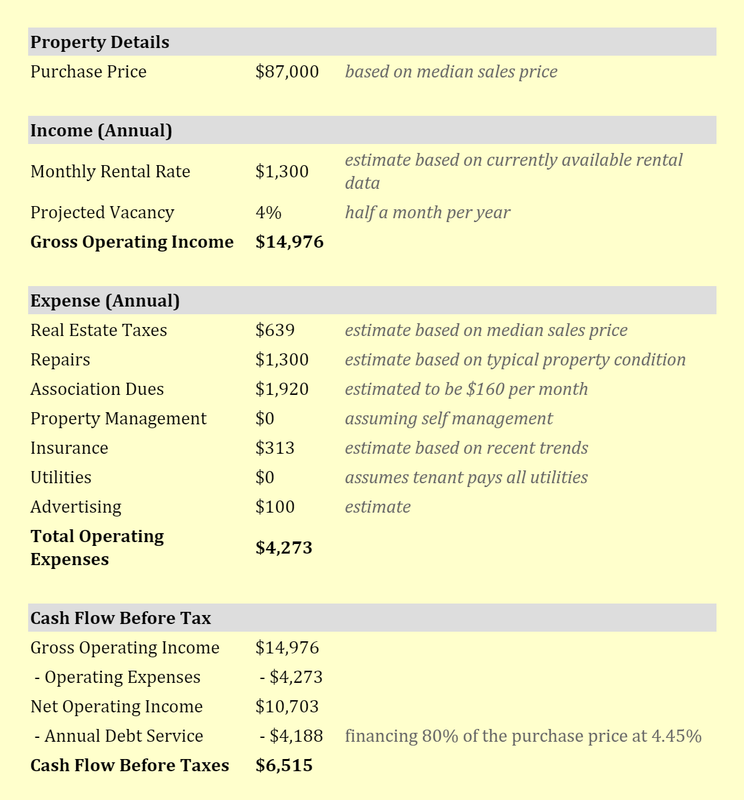

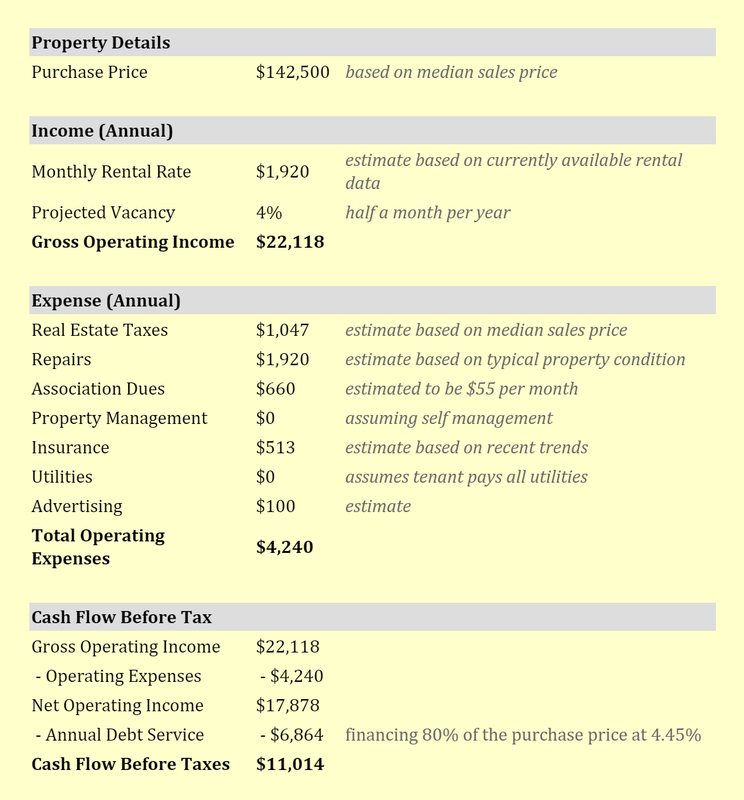

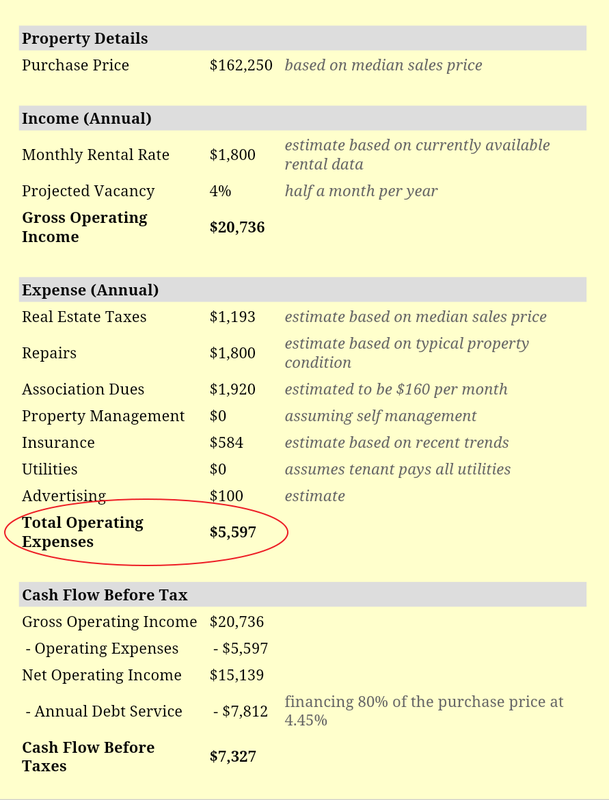

This is a continuation of a serious entitled: The Top 10 Terms of Commercial/Investment Real Estate. Most buy and hold real estate investors agree that cash flow is the ultimate goal. To calculate cash flow, you take the NOI and subtract it by the Debt Service. NOI - Debt Service = Annual Cash Flow See how the cash flow is calculated for Pheasant Run in Harrisonburg. Click here for available properties. This is a continuation of a serious entitled: The Top 10 Terms of Commercial/Investment Real Estate.

Cash Flow Calculations Source: http://www.harrisonburginvestmentproperties.com/pheasant-run/ Debt service is simply the mortgage payment associated with a property. This can be annualized by multiplying one payment by 12.

If you are considering purchasing a property that has a NOI of $60,000. To better understand what your cash flow will look at, you will want to subtract your debt service from the NOI. Example Property 1 NOI: $60,000 Monthly Mortgage Payment: ($896 x 12) Debt Service - $10,752 Cash Flow $49,248 This is a continuation of a serious entitled: The Top 10 Terms of Commercial/Investment Real Estate. The net operating income is the income minus the expenses excluding the mortgage. The NOI is used to help determine the profitability and value of a property. So, the NOI is effectively what the property would be making a person who buys in cash. Here's an example.

Annual Income: $100,000 - Annual Operating Expenses: $45,000 __________________________________________________ Net Operating Income (NOI): $55,000 The NOI is important if you are thinking about purchasing a property. It will not only give you a sense of what you will be earning but it will also help the bank determine if you can afford the mortgage payments. If you own the property, it's a helpful tool to help determine the value of your asset. Furthermore, you can look to increase the value by increasing the NOI. This is a continuation of a serious entitled: The Top 10 Terms of Commercial/Investment Real Estate. Operating Expenses are what it costs to run a business. Some examples of operating expenses include: taxes, insurance, utilities, management fees, landscaping, maintenance, repairs, and advertising. The following is what buying a Campus View Condo may look like. The expense sheet is from HarrisonburgInvestments.com This is a continuation of a serious entitled: The Top 10 Terms of Commercial/Investment Real Estate.

Effective Gross income is also known as EGI. This number is one of the first things you will want to look at when determining a property's income potential. This will be a key figure in determining the Net Operating Income.

Keep in mind that you can add other income sources such as parking, vending machines, laundry, etc... The following is an example of calculating EGI: Gross Income – Vacancy Costs (vacancy rate (%) x income = $ amount) – Credit Loss (i.e. collections, evictions, etc) = Effective Gross Income (EGI) For example, using the same property information above: Gross Income: $120,000 (minus)Vacancy Rate (20%): $24,000 (minus) Credit Loss (2%): $2400 (plus) Additional Miscellaneous Income (Laundry, Parking, etc.): $3500 =Effective Gross Income (EGI): $97,100 This is a continuation of a serious entitled: The Top 10 Terms of Commercial/Investment Real Estate. Example Source: Biggerpockets.com Vacancy rate is the percentage of vacant units in comparison to all the units in the property.

Vacancies Total Units An example would be if a hundred unit property had 5 vacancies, the property would have a 5% vacancy rate. As mentioned in the Vacancy blog, one could purchase a property at a discount, due to a high vacancy rate, solve the reason for the vacancy, fill the vacant units, and then have a more valuable property. This is a continuation of a serious entitled: The Top 10 Terms of Commercial/Investment Real Estate. Gross income is the total amount of income you can get in a property. This is important to understand because this number isn't necessarily guaranteed. For example, if a property has 4 units that rent for $500 a month, the gross income would be $2,000 a month. However, this property may only be partially rented.

Having a property only partially rented could be a bonus if the purchase price reflects the occupancy status. In other words, if you buy the property and make do what it takes to make it fully rented, you can increase the value of the property quickly. In addition to rent, other items such as coin operated laundry, storage fees, late fees, vending machines, etc, can be factored into gross income. Top Ten Terms for Commercial and Investment Real Estate |

Categories

All

|

Email - Click Here

Phone - 540-246-9067 Website - www.mattiasclymer.com Schedule a Meeting, Download Contact Card, Etc... |

Funkhouser Real Estate Group | 401 University Boulevard, Harrisonburg, VA 22801 | 540-434-2400 | ©2021 | Privacy Policy | All rights reserved.

Licensed in the Commonwealth of Virginia

RSS Feed

RSS Feed