Diving into Real Estate Investing

I am excited to announce that Chase and I will be reviewing the full process on how to buy your first, or next, investment property! This topic will be broken up into two parts to give a full, in-depth guidance on closing an investment property.

Tonight we will cover Part 1:

Tonight's Meeting Starts at 6:00 PM

Whether you are a complete newbie or experienced investor, we are sure you will learn new tips and resources to help with your current investment process as we take a deep dive into investing in the local real estate markets! Join us live at 6:00 pm on the Harrisonburg REI website.

Can't make the meeting? We have recordings of all our previous meetings on the website as well. What is the Harrisonburg Real Estate Investor Network?

The Harrisonburg Real Estate Investors network is a group of experienced investors, agents, lenders, attorneys, insurance brokers, contractors, and real estate newbies looking to grow their business. They focus on real estate investing ranging from residential to multifamily investments and active to passive real estate investing. Their goal is to establish a community of real estate professionals, both amateur and experienced, that creates the network and environment to grow everyone’s business. Check out their Facebook page or join their Meetup group to get more information about upcoming meetings!

0 Comments

COVID-19 has changed just about every aspect of our lives, from the way we interact with others to our work environment. In the past four months, several companies have instituted work from home policies and have found that employees are not only still able to get their work done, but many of them enjoy working remotely. Working remote means that employees cut out their commute time, giving them more time to spend with their family. It also cuts down expenses for the company in utilities and rent on the office space they lease. Many companies are now considering keeping some of their workforce remote, even as restrictions ease. Aside from lowering their costs, they are also able to hire from a much broader pool of candidates by allowing employees to work virtually anywhere. So, if you don’t have to live close to where you work, what does this mean for the housing market? In general, potential homebuyers are house hunting in the suburbs and more rural areas. Many of the attractive aspects of city life have been put on hold during the pandemic in the name of social distancing. Meanwhile, urbanites may feel cooped up in small apartments, apprehensive about sharing amenities and common spaces (elevators, laundry rooms, on-site gyms) with their neighbors. A survey of 1,004 people by the International Council of Shopping Centers found that twenty-seven percent of adults in the U.S. are considering moving because of COVID-19, and many of them are looking to the suburbs or rural towns. Realtor.com surveyed 1,300 people over the first two weeks of April and found that 15.7% of homebuyers want more space in their next house and 13.6% want “more and better outdoor space.” For many people, being able to work remotely means they can afford their dream home by moving away from the city, where the cost of living is often quite high. In fact, Vic Lederman of Stansberry Research makes the case that remote workers in the tech industry (like Facebook or Twitter) will make well above the U.S. median household income level and so if they settle in these more rural towns, the entire area will experience a rising-tide effect. That said, working from home isn’t everyone’s ideal situation. Some employees are anxious to get back to the office, away from the distractions of home. While these employees may want to stay within driving distance of the office, we could see more offices move to the suburbs as they seek more affordable buildings with sprawling floors that are conducive for social distancing. Whether or not this trend will be short-lived or the new way of doing business, the need for social distancing has certainly created a desire for more space on both a personal and commercial level. Sources:

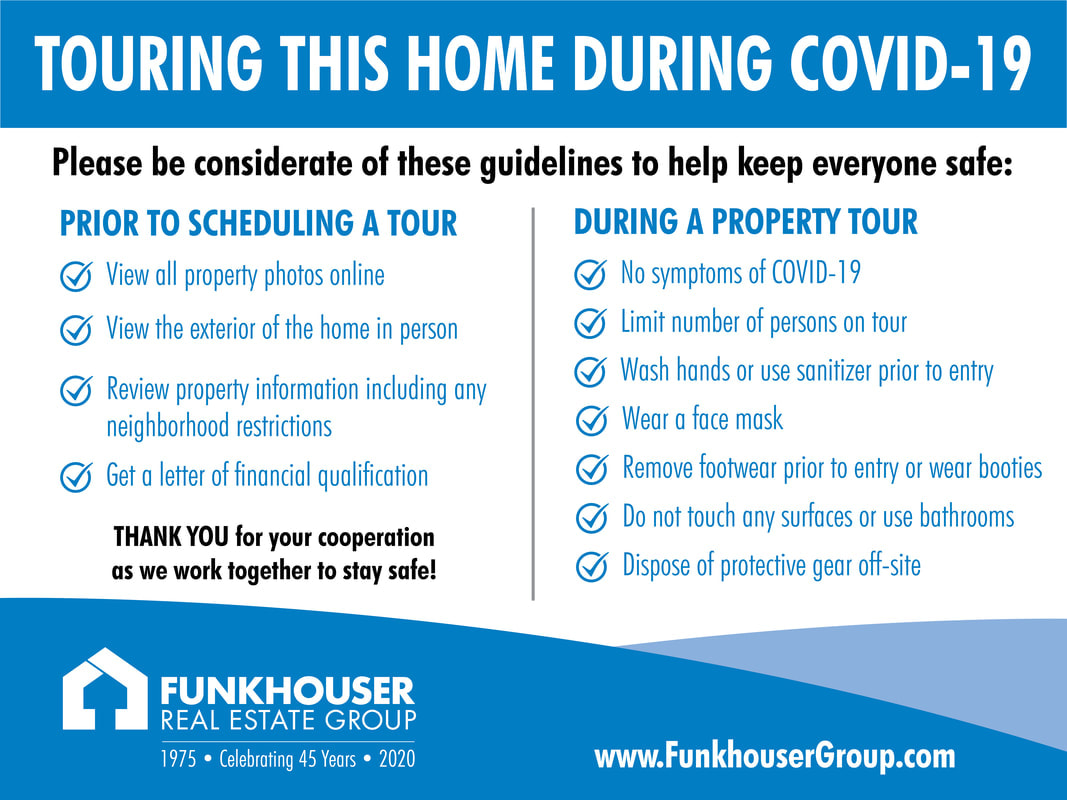

https://www.forbes.com/sites/jennifercastenson/2020/06/08/value-of-home-life-is-back-and-has-land-buyers-moving-way-out/#69bd86b271f1 https://www.cnbc.com/2020/06/18/coronavirus-update-people-flee-cities-to-live-in-suburbs.html https://www.realtor.com/research/top-consumer-home-features-coronavirus/ https://www.cnbc.com/2020/05/31/after-flocking-downtown-to-woo-millennials-offices-might-move-back-to-the-burbs.html https://stansberryresearch.com/articles/capitalisms-next-rising-tide-is-here More Reading: https://www.realtor.com/news/trends/frantic-new-yorkers-snatch-up-unwanted-homes-in-the-suburbs/ https://www.pymnts.com/news/retail/2020/pandemic-might-launch-flight-to-suburbs/ https://www.usatoday.com/story/money/2020/05/01/coronavirus-americans-flee-cities-suburbs/3045025001/  Client Care Packages provided by Funkhouser Group Client Care Packages provided by Funkhouser Group Even in the face of COVID-19, the real estate market in Shenandoah Valley remains active. Funkhouser Group has put several precautions in place so potential buyers and sellers can continue to purchase or sell homes while social distancing. At this time, buyers should do the following before scheduling a tour:

Yard Sign Options for Sellers Yard Sign Options for Sellers These guidelines are listed on a yard sign that is available to all sellers working with Funkhouser Group. Additionally, there are safety measures listed for property tours as well. These include:

If you are closing on a house as a purchaser or seller, you may be wondering what that process looks like during the COVID-19 outbreak. Settlement agencies have been in operation during the pandemic as they are an essential business but many of them have had to readjust their typical settlement procedures to ensure the safety of their staff and clients.

New Practices Under Virginia's Stay-at-Home Order

Certain procedures will vary between title agencies as each company decides what is best for their office. West View Title Agency has temporarily closed the office to the public and is handling closings over the phone while the seller or purchaser signs the documents from their car or a table in the parking lot, still within sight of a processor who can notarize the documents. According to Stewart Title’s website, they are limiting who attends closings, disinfecting between all clients, and maintaining 6 feet of distance (in addition to other safety precautions). Other agencies may require you wear a mask at closing or email photocopies of your driver’s license prior to settlement. If you aren’t sure what your own settlement agency’s policies are, a quick call can help you prepare for a contact-less/ limited-contact closing.

Closing in the Future as the State Slowly Re-opens

While the new practices for closing are not ideal, they are in place to prevent coronavirus from spreading. Setting aside the health ramifications, it’s important to keep in mind that if one employee gets sick at a title agency (particularly a smaller agency where the employees work closely together), it could require several people in the office to quarantine for two weeks which would slow down transactions. In the case of West View Title Agency, future closings will likely be handled differently than they were pre-pandemic. Buyers and sellers will close separately and only those who are signing documents would be allowed in so social distancing is still observed. Masks will probably be required as well. Regardless of how a title agency decides to operate, preventing the spread of COVID-19 is still up to every individual and we should all continue to follow recommendations from the WHO and CDC.

A huge aspect of purchasing a home is finding the right mortgage loan for you. There are several different types of mortgages that each have their own advantages and disadvantages. You should always speak with a mortgage lender to review what your best options would be. Below is a brief outline of some of the most common loans you may want to consider. While reviewing mortgage loans might not seem exciting on the surface, just keep in mind that the right mortgage loan can help save you money and planning how to spend that extra money is definitely exciting.

Conventional Loans

These loans are most often conforming, meaning they stay within the federal limits set by Freddie Mac and Fannie Mae (government owned mortgage purchasers). In the Shenandoah Valley the cap is $510,400. With these loans, if you put down less than 20% of the purchase price for the home, you will pay a Private Mortgage Insurance premium each month until you reach 20% equity in your home.

Fixed Rate Loans

This is the most common mortgage loan, making up 75% of all home loans. These loans come in 15, 20 and 30 year terms. While the 30 year term is the most popular, the 15 year term will build equity faster, in part due to a lower interest rate. The interest rate stays fixed so the monthly payments remain the same for the duration of the loan; this is great for budgeting and there are no surprises down the road if you plan to stay in your house for several years. The down-side is that you could end up paying more in interest than you would with a different kind of loan.

Adjustable Rate Mortgage Loans

With ARM loans, there is an introductory period when the interest rate is fixed (one month to 10 years) after which the loan interest rate can fluctuate according to the index they are tied to. ARM loans can be attractive to buyers who don’t plan to stay in their house long-term because their initial rates are typically lower than the fixed rate loans but they come with the risk of a much higher interest rate after the fixed period.

Government Agency Backed Loans

Unlike conventional loans, these loans have more restrictions; investment properties and second homes are typically not eligible. However, these loans offer a much lower down payment and typically lower interest rates.

VHDA Loans

Virginia Housing Development Authority offers a variety of loans designed to meet the needs of Virginia's homebuyers, including Conventional 30 Year Fixed (Fannie Mae No MI, Fannie Mae Reduced MI), plus FHA, VA (Veterans Affairs), and RHS (Rural Housing Services) loans which are listed below. VHDA also offers a down payment assistance grant, closing cost assistance, and mortgage credit certificates. Something to keep in mind is that most VHDA loans are only for first time homebuyers and there is a maximum income and loan limit by region.

FHA Loans

Federal Housing Administration Loans come in 15 or 30 year fixed rates and offer a low down payment requirement (can be as low as 3.5%), plus the ability to use a financial gift or inheritance for the down payment. Lower credit score and debt-to-ratio requirements are also advantages to FHA loans, particularly for first time homebuyers. The biggest drawback is that FHA borrowers must pay an upfront mortgage insurance fee of 1.75% of the total loan amount, as well as a monthly premium regardless of down payment size.

USDA/ RHS Loans

United States Department of Agriculture offers Rural Housing Service Loans. They can be a good option if you wish to purchase a single family home that is located in an eligible, rural area. This loan offers a no down payment option and tends to have lower interest rates than a conventional mortgage. The disadvantages to USDA loans are that you will have to pay mortgage insurance premiums and there is an income limit (for Harrisonburg Metro area- not the city itself, which is not eligible- this is $86,850 for a 4 person or less household) as well as a loan limit ($265,400 for Rockingham County).

VA Loans

If you've served in the United States military, you may qualify for a Veterans Affairs loan. A VA loan doesn’t require a down payment and there are no mortgage insurance requirements. There is also no minimum credit score requirement and interest rates tend to be lower. Because these loans come with so many benefits, there are a few restrictions; the property in question must be your primary residence, and it must meet “minimum property requirements" (not a fixer upper) which can prolong the appraisal process. There is also a funding fee associated with the loan.

There are several other, lesser-known mortgage loans (such as Balloon, Bridge, Jumbo, Interest-Only, Rental Property, etc) that may warrant some additional research as you determine the best loan for your situation. While one mortgage type may work for your friend or relative, it may not be the best fit for you which is why you should work with your lender and review the terms of any loan carefully.

Sources:

https://www.consumerfinance.gov/consumer-tools/mortgages/answers/basics/ https://www.fmbankva.com/fixed-rate-loans/#tab-id-1 https://www.mortgagecalculator.org/helpful-advice/types-of-mortgages.php https://www.bankrate.com/finance/mortgages/5-basic-types-of-mortgage-loans-1.aspx https://www.realtor.com/advice/finance/types-of-mortgages/ https://www.vhda.com/Homebuyers/VHDAHomeLoans/Pages/VHDAHomeLoans.aspx https://www.rd.usda.gov/files/RD-GRHLimitMap.pdf https://www.bankrate.com/finance/mortgages/virginia-jumbo-loan-limits-by-county.aspx https://www.fhfa.gov/DataTools/Downloads/Documents/Conforming-Loan-Limits/FullCountyLoanLimitList2020_HERA-BASED_FINAL_FLAT.pdf https://www.investopedia.com/terms/r/rhsloan.asp Avoid Changing your Financial Profile

If you have your house under contract, this probably means that you have gotten a pre-approval/qualification letter. Your lender will now make a formal loan application. This application is based on your finances at that point. It is vital that you don't make significant changes to you finances until after you close. Problems can occur if you buy a car, open new lines of credit, change jobs, acquire other significant debt, etc. It is a good idea to talk to your lender before making significant purchases that would out you into debt. You also don't want to spend your down payment/ closing costs.

From there, you will have a number of items to complete before closing. Contract to Closing Check List

When going over the contract, my clients often get overwhelmed. There are a lot of deadlines in the contract that can have serious consequences if missed. I always assure my clients that they don't need to remember all the dates. My goal is to make sure you are informed and on top of everything from contract to closing.

To achieve this, I take all the critical dates and things you should be aware of and put them on a checklist. I then send you regular updates on what the next action items are. This way, if you want to get ahead of the game, you have access to all the steps but if you find all the steps overwhelming, I will break them down and give them to you as needed. Buying a house is one of the biggest financial decisions the average person makes. I am here to make that process as smooth and as painless as possible.

In my last post on buying and selling a home at the same time, we looked at some scenarios in which it’s best to sell your existing home first and then buy your new home. But there are also scenarios in which it’s advantageous to buy first and then sell.

Buying First

Let’s look at two examples of scenarios in which it can be better to buy first, and some steps to take to help you plan it all out.

Available Funding

If you have the funds available to buy a new home before selling your old home, you should take advantage of this fortuitous situation. There are several reasons why it’s a good idea to buy first in the event that you can manage it. Buying first can be the least stressful way to move for a few reasons:

Steps to Follow

Identify and liquidate your assets to be able to make a good offer, also have documentation that you have the funds available

Moving From a Hot Market To a Slow Market

In this scenario it makes sense to buy first because it will be easy to get an offer accepted in the slow market and easy to sell quickly in the hot market. This can happen in Harrisonburg/Rockingham when moving from houses at the median sales price to more expensive neighborhoods. Statistically, there are less people competing the further away you get from the median sales price.

People can shy away from this option because you will be hold two mortgages for a period of time. Some clients are more comfortable with this than others. If you are considering this as an option I would be happy to meet and discuss timing this move. Each situation is unique. Depending on your desire to move slowly, clean, and stage we can get the property marketed quickly. Since I do my own marketing, I can typically be flexible to get the house on the market in a timely manner after it is ready. Pricing plays a larger role in how quickly the property will sell once it hits the market. However, in a hot market, good marketing and correct pricing can result in a quick contract. The contract can then likely be negotiated for a 30 day settlement. So, it is possible for you to only hold the two mortgages for two months. We of course would want to be prepared for unexpected circumstances and be okay with it potentially taking a little longer. For homeowners who don’t want to worry about having two mortgages at the same time, there’s another option, which is making a contingency offer. This can be a nice safety net if you really do not want to hold two mortgages for any given amount of time. Some sellers may not be willing to enter into this type of contract but it is not completely uncommon in a sellers market. Steps to Follow

Pros and Cons

Although it can require more cash on hand, for many homeowners there are still some situations in which it’s better to buy first and then sell later. Here is a look at some pros and cons of buying before selling.

Pros to Buying First

Cons to Buying First

Feeling pressure to sell quickly may cause you to take a lower offer than you would otherwise

Now you have the case for buying before selling, as well as the case for selling first, which we laid out in our previous post. There’s no one right decision, as it depends on your unique situation. So weigh the pros and cons, and go with your gut instinct.

Buying and selling a home at the same time is a complicated process. Here are some practical tips that will help things go more smoothly.

Find an experienced agent

Given the complexity of buying and selling at the same time, you will want the help of an experienced real estate agent. An experienced agent will be able to help you price your home optimally, and will be an expert at timing the sale of your home, negotiating the price, and strategies for buying and selling at the same time. Choosing the listing price is one of the most important functions of a listing agent, and you’ll want someone who really knows the local market.

If you think you are ready to discuss the best strategy for your situation, I'd love to meet up with you. If you want more information about my experience, see here. Determine if you’re in a buyer’s market or a seller’s market

The steps that you take in selling and buying a home will differ depending on the local market. If you’re moving to a different town, you will be selling your home in a different market than the one you’re buying in. In a buyer’s market, there are more homes up for sale then there are people looking to buy. You may find a new home before you sell your own home. In a seller’s market, there are more people looking to buy then there are homes for sale. You will likely sell your old home before finding a new home.

There is not a one size fits all solution for everyone. You have to determine what works best for you and your situation. Here would be some examples of strategies give the market conditions. If you’re in a… Buyers market Make an offer with a kickout clause (in this case the purchase of the new home is contingent on the sale of the old home). Buyers market Request an extended closing. This will help give you time to sell your current house. Sellers market Make an offer with an extended closing and trust your house will sell. This may feel risky but depending on your house and financial situation, it can work out very well. Pricing your old house will be very important in this option. Sellers market Sell your house first and negotiate a rent back agreement. This will give you sometime to shop for a new house without having to move into a temporary rental. Know your financial situation

The next step in the process is to take stock of your financial situation. You will want to talk to your mortgage company and your accountant or financial advisor to find out the following information. You’ll want to know how much liquid cash you have on hand, how much equity you have in your home, and what types of loans you qualify for. Ask me for recommendations.

A key part of your financial situation is the value of your home. You will want to find out how much your home is likely to sell for. As part of determining the value of your home, you may want to get a pre-inspection to find out how much work will need to be done in order to sell your home. This is also an ingredient in determining how much equity you have in your home. Equity is the amount of money left over after you take the market value of your home and deduct the amount that’s left to pay on your mortgage. In other words, it’s the amount you’ve already paid toward the current value of your home. Buy First or Sell First?

Now you have some tips to help you in the process of buying and selling at the same time. But which should you do first, buy your new home or sell your old home? We’ll look at some different scenarios for selling and buying your home in our next posts!

In our last post we discussed how to figure out how much home you can afford. The next question to answer is, what will your money buy you? That all depends on the market that you’re in. The same amount of money may buy you a mansion in a rural area and a small apartment in an urban center.

Buyer’s Market vs. Seller’s Market

In addition to the location you’re looking in, the state of the market at the time you’re buying will also help to determine how far your money will go. Whether you’re in a buyer’s market, a seller’s market, or a neutral market will affect how far each dollar stretches. In a buyer’s market, there’s more inventory on the market than there are people looking to buy homes, pushing prices down. Your money will go further and you’ll have more options to choose from. In a seller’s market, there’s less inventory on the market than there are people who want to buy homes and the homes on the market can demand a higher price, squeezing your budget. In a seller’s market you may have to make a few different offers on homes before you can find the right fit. A buyer’s market is an easier deal.

The Local Harrisonburg and Rockingham Market

Take a look here to find detailed analysis of the local market, and enter your email below to subscribe to monthly market reports.

No matter the market conditions, there are always opportunities. Sometimes opportunities require the house to be renovated. There are loans to help with those costs. This can require a significant down payment but not always.

There are also areas where your dollar can stretch a little further. It just depends on what you are looking for. Some of these areas include Broadway/Timberville, Grottoes, Weyers Cave (Augusta), Massanutten, and Elkton. Sources: https://www.zillow.com/home-buying-guide/can-i-afford-a-house/, https://www.redfin.com/guides/buyers-market-vs-sellers-market

A home is, for most of us, the biggest expenditure we will ever make. How do you figure out how much home you can afford?

The Calculations

New websites for homebuyers make it easy to make these calculations, once you know the key numbers to plug in. The biggest number is your gross annual income. Once you have that figured out, you will need to figure your monthly debt. Be sure to include all forms of debt like credit cards, car payments, school loans, etc. The third number you will need is the amount you can make on a down payment. If you have these three numbers, you can just plug them into a calculator, like this one from Zillow. There are quite a few such calculators available on the web. For a slightly more complex formula that includes your credit score and the zip code you’re interested in, go to Nerd Wallet.

Debt To Income Ratio

The main thing that you want to find out from these calculators is your DTI, or debt to income ratio. If you used Zillow’s calculator to figure out how much you can afford to spend on a home, you can then go to their DTI calculator and figure your overall debt to income ratio. A good DTI is considered to be 36% or lower. According to the 36% Rule, you should never let your DTI exceed 36%. In order to be considered for a Qualified Mortgage, 43% is the highest DTI that you can have. It’s important to have a Qualified Mortgage because they have better protections for borrowers, such as a limit on fees.

Mortgage Calculator

Another nifty tool you can play with on the Zillow site, Nerd Wallet, or other sites is a mortgage calculator. This tool can show you different interest rates for different time periods, like a 15 year mortgage versus a 30 year mortgage. Playing around with different numbers will give you a sense of how you would need to budget and what the overall cost would be for different mortgages. Once you have a sense of how much you can spend on a home, then you will need to consider what the housing market is like in the area you want to buy. More on that to come . . .

Sources: https://www.zillow.com/home-buying-guide/can-i-afford-a-house/, https://smartasset.com/credit-cards/what-is-a-good-debt-to-income-ratio https://www.zillow.com/mortgage-calculator/house-affordability/, https://www.nerdwallet.com/mortgages/how-much-house-can-i-afford/calculate-affordability, https://www.zillow.com/mortgage-calculator/debt-to-income-calculator/, https://www.zillow.com/mortgage-calculator/ https://www.nerdwallet.com/mortgages/mortgage-calculator/calculate-mortgage-payment?trk=nw_gn1_4.0 |

Categories

All

|

Email - Click Here

Phone - 540-246-9067 Website - www.mattiasclymer.com Schedule a Meeting, Download Contact Card, Etc... |

Funkhouser Real Estate Group | 401 University Boulevard, Harrisonburg, VA 22801 | 540-434-2400 | ©2021 | Privacy Policy | All rights reserved.

Licensed in the Commonwealth of Virginia

RSS Feed

RSS Feed