Profiting in a Competitive Real Estate Market

This month we had Nhan Lam guest speaking on: How to Profit in a Competitive Real Estate Market. Nhan is a true entrepreneur who owns and operates several successful businesses. As the son of a family who escaped communist Vietnam in the 1970s, he was conditioned to never be complacent. His parents taught him to never take the freedoms we have in America for granted and that he should always give his best in everything he does. He has a Master’s Degree in Aerospace Engineering, and he achieved great success in Corporate America. However, despite his high salary, he knew that his job would not help him achieve the goals that he desired, which were to retire his parents, be a stay-at-home parent, and have the true freedoms that were meant for every American (the freedom of choice).

He continually sought out business opportunities in his spare time and became successful in several of them on a part-time basis but realize that his passion was in real estate. In 2011, he decided to attend a Real Estate Rehabbing Bootcamp. From there, he applied what he learned to building a sustainable real estate business while he was still working on his full-time job. Within 2 years, he replaced his full-time income and left his job. He is a father to 5 children and the thing that he enjoys the most is his ability to be flexible to the needs of his family. Since going full time, he averages 12 to 15 deals per year which includes Rehabs, Wholesales, and Rentals and has also started a Real Estate Investing Education company to help students get started. As of 2022, he has trained almost 1,000 students face to face or virtually through his bootcamp trainings and mentoring programs and is proud to say that the success rate of his students are well above industry average. He contributes this success to his commitment to provide a customized business plan for students based on the skills they have today and not commit them to long-term learning that may lead to nowhere. He believes that the measure of success is not by how much money you make, but instead by how many people you have helped along the way to achieve the same success. Watch the Recorded Meetup HereWhat is the Harrisonburg Investors Network?

The Harrisonburg Real Estate Investors network is a group of experienced investors, agents, lenders, attorneys, insurance brokers, contractors, and real estate newbies looking to grow their business. They focus on real estate investing ranging from residential to multifamily investments and active to passive real estate investing. Their goal is to establish a community of real estate professionals, both amateur and experienced, that creates the network and environment to grow everyone’s business. Check out their Facebook page or join their Meetup group to get more information about upcoming meetings!

1 Comment

October's Meetup

This month, Chase Louderback & Mattias Clymer covered how to invest in rental property. Whether you are a new real estate investor or seasoned landlord, you will benefit from learning the different strategies to build, and compound, your long-term wealth. If you weren't able to join Harrisonburg REI's virtual meetup, check out the recorded meeting below to learn how some investors are still finding rental real estate deals in a HOT market!

What is the Harrisonburg Real Estate Investor Network?

The Harrisonburg Real Estate Investors network is a group of experienced investors, agents, lenders, attorneys, insurance brokers, contractors, and real estate newbies looking to grow their business. They focus on real estate investing ranging from residential to multifamily investments and active to passive real estate investing. Their goal is to establish a community of real estate professionals, both amateur and experienced, that creates the network and environment to grow everyone’s business. Check out their Facebook page or join their Meetup group to get more information about upcoming meetings!

A little bit about my real estate background...

I got my license in 2014 and since then I have had the honor of being named a Top Agent by Virginia Living Magazine, a Top Agent in America and in the top 5% of local agents in production and negotiation by HomeLight. In addition to sales, I am passionate about micro loans and created a local KIVA team that provides loans to those who could not otherwise get financing. My passion for real estate investing eventually led me to start an investment club in 2017. I later joined forces with Chase Louderback to create the investors club we have today.

Join us tonight from 6-8pm

I have not only sold short term rentals to clients but also taken a deep dive into understanding how to create successful short term rental business locally. Tonight I will be discussing how I analyze a property to see if it makes sense as a short-term rental as I dissect a previously listed short term rental that was for sale.

Join the meeting here. About Harrisonburg Real Estate Investors Network

The Harrisonburg Real Estate Investors network is a group of experienced investors, agents, lenders, attorneys, insurance brokers, contractors, and real estate newbies looking to grow their business. They focus on real estate investing ranging from residential to multifamily investments and active to passive real estate investing. Their goal is to establish a community of real estate professionals, both amateur and experienced, that creates the network and environment to grow everyone’s business. Check out their Facebook page or join their Meetup group to get more information about upcoming meetings!

Space. Do we ever have enough of it? Whether your home is a studio apartment or a mega-mansion, somehow stuff seems to multiply to fill any amount of space. Fortunately, there’s no end to human ingenuity, and there are a plethora of ideas out there for maximizing space. Here are some options that can work for any size home. 1. Make Your Furniture Do Double-Duty

Try to acquire furniture with built-in storage. You can find beds and benches with built-in drawers or shelves, coffee tables or ottomans that are also bins, and many other innovative combinations. The more you can turn your furniture into storage space, the more spacious your home will feel.

2. Sleep On It

Virtually any bed can be used for storage space. Simply tuck your things away neatly in bins under the bed. If your bed is low to the ground, you can lift it up with some wooden blocks. This creates a great deal of storage space that’s out of sight

3. Maximize Your Hangers

Use cascading hangers in your closet to increase the amount of clothing you can hang in the space. Shirts and pants are particularly well-suited to storage on cascading hangers and will create quite a bit of space in your closet.

4. Hang Your Shoes Up

Over-the-door shoe organizers can also help you maximize your closet space. They typically hold 12 or more pairs of shoes, and can also accommodate other small clothing items or accessories. They make your items easy to locate and put away.

5. Shrink Your Stuff

Use vacuum storage bags to compress and puffy or fluffy items and make them easier to store in a small space. This works with comforters, sheets, towels, etc. Simply place your items in the bag and use your vacuum cleaner to suck the excess air out of them.

6. Make It Float

Install hooks or dowels in the wall to hang various items. You can hang light weight things like pots and pans in the kitchen, or heavy items like a bike. If you are hanging something heavy, make sure the hook or dowel is installed in a stud so it can support the weight. If you have many small items you want to hang, consider using a pegboard.

7. Elevate It

Shelves are a great storage tool, whether you have items you want on display, or out of the way. Shelves can be integrated into any room in the home for books, artworks, or keepsakes. If you have items that you only need on occasion, like holiday decorations, you can install shelving in a closet above or behind other items.

8. Compartmentalize It

Almost any shelf, drawer or cabinet can be further compartmentalized to increase organization and maximize space. Stack boxes or bins on shelves, put dividers in drawers, and install pull-out drawers in cabinets.

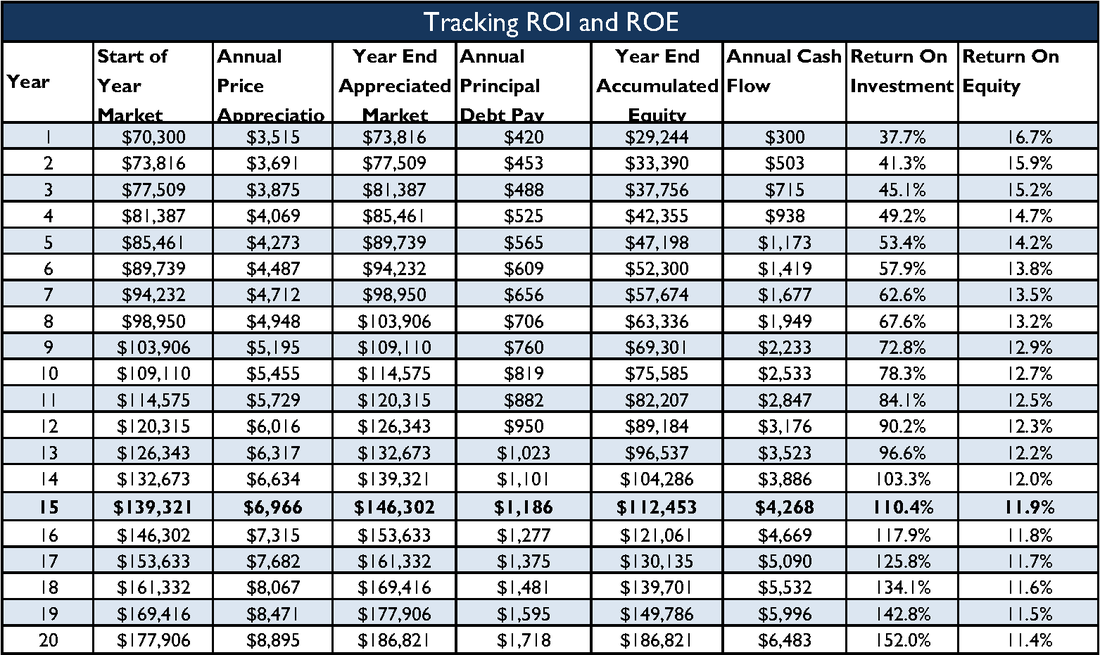

Sources https://www.zillow.com/blog/large-items-small-spaces-220378/ https://morningchores.com/bathroom-storage-ideas/?utm_source=imagepin https://www.apartmenttherapy.com/small-bedroom-ideas-the-5-smartest-ways-to-get-more-storage-in-your-sleep-space-207910 https://www.bhg.com/decorating/storage/organization-basics/living-room-storage-furniture/?slide=slide_0122ceb5-f5ec-4fbf-92d1-6936698cf1e2#slide_0122ceb5-f5ec-4fbf-92d1-6936698cf1e2 https://makespace.com/blog/posts/bedroom-storage-hacks-solutions/ Why do real estate investors leverage their investment properties? The most obvious answer is that the more they leverage, the more properties they can purchase. If purchased correctly, each property should generate positive cash flow. Not only do the investors get more monthly cash flow with more properties, but they also have more renters paying down more mortgages creating more equity. Another reason investors leverage their money is because of the Return on Equity (ROE). The ROE is calculated by dividing the total annual return by the equity. As you can see in the chart below, your ROE goes down as your equity goes up. This is why some investors choose to pull their equity out of existing investments and use them to obtain new investments. One word of caution: the more you leverage, the more you risk. Some investors choose to pay their mortgage off and simply receive returns on through cash flow. Chart is from The Millionaire Real Estate Investor

Keep Your House as a Rental

Have you considered buying another house and renting your current residence? Have you wondered how much cash flow you would get but aren't sure how much you could bring in for rent?

Determining a rent price is very similar to determining the value of a property. Ultimately, the value of a property and the rental cost are what people are willing to pay for the property. Finding comparable houses that have been rented out is the best way to determine a rent price for you home. Finding Rental Comps

If you are planning on using a property manager, contact me to give you recommendations. You don't need to read further because they can do most o the leg work for you.

If you want to manage your own property, finding rental comps can be difficult. There is not a good system used in this area to keep track of agreed upon rental prices. What you can do is check what people are asking for in your neighborhood and/or in similar homes nearby. MLS Anything in the MLS will be listed on my website. Zillow You may be able to find a few additional resource on Zillow Craigslist Craigslist will likely have a lot of different advertised rentals. Local property management groups can also be a useful resource. Check out the following local property managment web pages: Riner Rentals Matchbox Realty Mountain Valley Management Rocktown Realty Finding the Average Rental Price

You'll want to take the average or median price amount from the group of similar homes you find. Depending on your situation, you could begin advertising the house at the higher end of the rental price range and see the responses you get. Ultimately, you will want to be very selective when choosing a renter. It's best practice to contact their past 3 landlords to learn about evictions, property destruction, or failure to pay on time.

If you want to discuss this further, or help in finding comps, contact me at: (540) 246-9067. Have you been thinking about making a Real Estate investment? Is having rent come in once a month the only benefit to having an investment? Below I outline the four ways of making money with an investment property.

1. Cash Flow Cash flow is rent that exceeds the monthly mortgage payment. When looking to invest, talk to a mortgage adviser to see what your projected mortgage payments. Then, talk to a Realtor about going rental rates. 2. Appreciation in Value The average rate of appreciation is around 3%. Keep in mind, this fluctuates and you should be ready for a long term investment. Start getting to know areas around town where you may want to invest. Look for trends, does the neighborhood seem to be improving, or declining. Finding an up-and-coming neighborhood is a great way to accelerate appreciation in value. 3. Tax Benefits The government thinks it's beneficial for people to own homes. So, they offer tax benefits to home owners. You'll want to consult with a tax accountant about your eligibility for tax benefits. 4. Mortgage Payoff Finally, while your property is going up in value, you are enjoying tax benefits, and a monthly rental income, your renters are also paying down your mortgage. The rate at which your mortgage is paid down depends on your interest rate and the term of your loan. Theoretically, your renters could pay for the whole house aside from the down payment. |

Categories

All

|

Email - Click Here

Phone - 540-246-9067 Website - www.mattiasclymer.com Schedule a Meeting, Download Contact Card, Etc... |

Funkhouser Real Estate Group | 401 University Boulevard, Harrisonburg, VA 22801 | 540-434-2400 | ©2021 | Privacy Policy | All rights reserved.

Licensed in the Commonwealth of Virginia

RSS Feed

RSS Feed