|

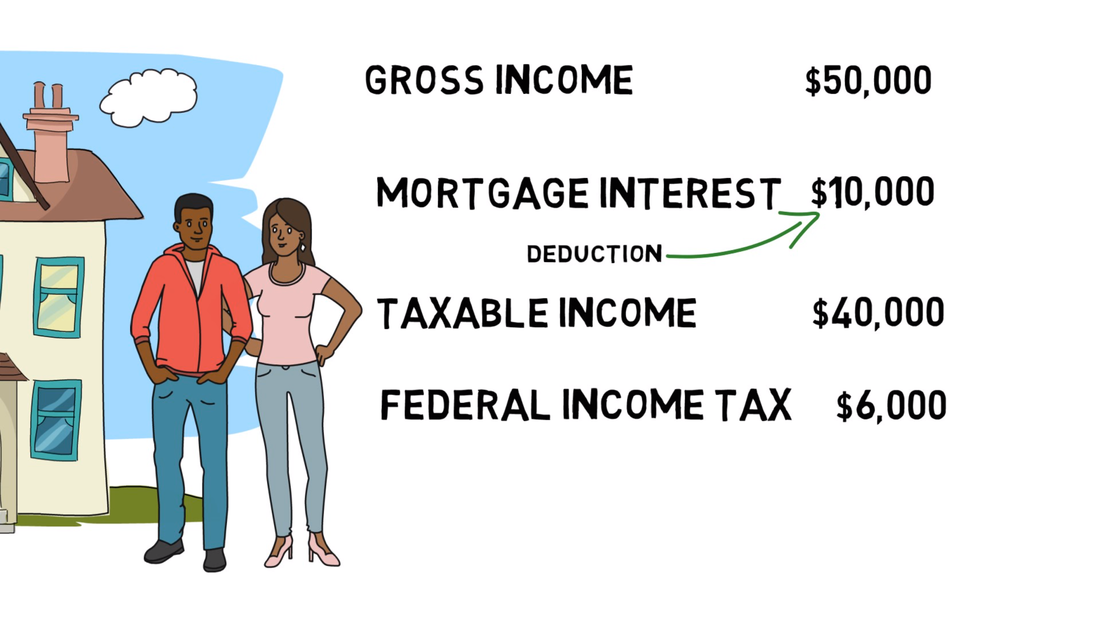

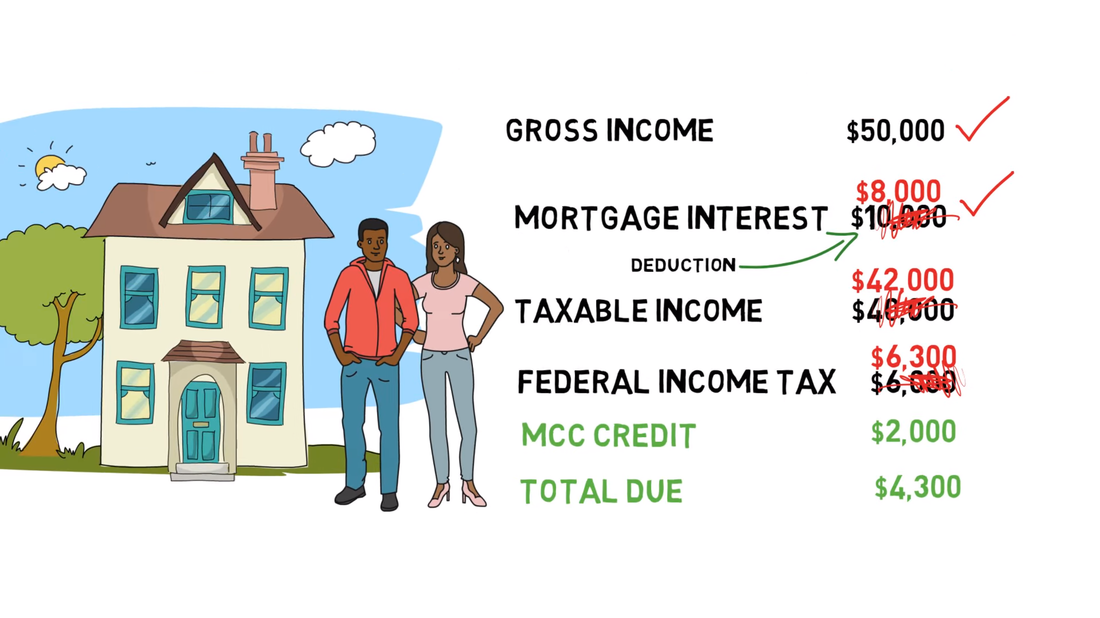

If you are a first time homeowner, or not owned a home as your primary residence for the past 3 years, you could be able to benefit significantly from a VHDA Mortgage Credit Certificate (MCC). How much? It's actually significant. Most people will take the interest they pay on their mortgage and deduct that from their taxable income. So, they wont pay taxes on the money earned that went to the mortgage interest. These savings depend on the tax bracket you are in. The MCC credit will let you take 20% of the interest you pay off of your total tax bill. You are then able to deduct the rest of the interest in the normal way. The video below spells out the savings pretty well. If you don't want to watch it, here are some screen shots that will explain the savings. This is what the normal deduction would look like. They are simply reducing their gross income by the interest they paid on their mortgage. This leaves them owing $6,000 in tax. Now lets look at how their taxes would look like with an MCC credit. Here we can see that their income and mortgage interest are still the same. However, they are only able to reduce their taxable income by 80% of the mortgage interest they paid because the other 20% is being applied through the MCC credit. As you can see, the total taxes they owe are $1,700 less with the MCC. If you are interested, be sure to watch the video below. Also check out VHDA's website for more information:

0 Comments

Leave a Reply. |

Categories

All

|

Email - Click Here

Phone - 540-246-9067 Website - www.mattiasclymer.com Schedule a Meeting, Download Contact Card, Etc... |

Funkhouser Real Estate Group | 401 University Boulevard, Harrisonburg, VA 22801 | 540-434-2400 | ©2021 | Privacy Policy | All rights reserved.

Licensed in the Commonwealth of Virginia

RSS Feed

RSS Feed