|

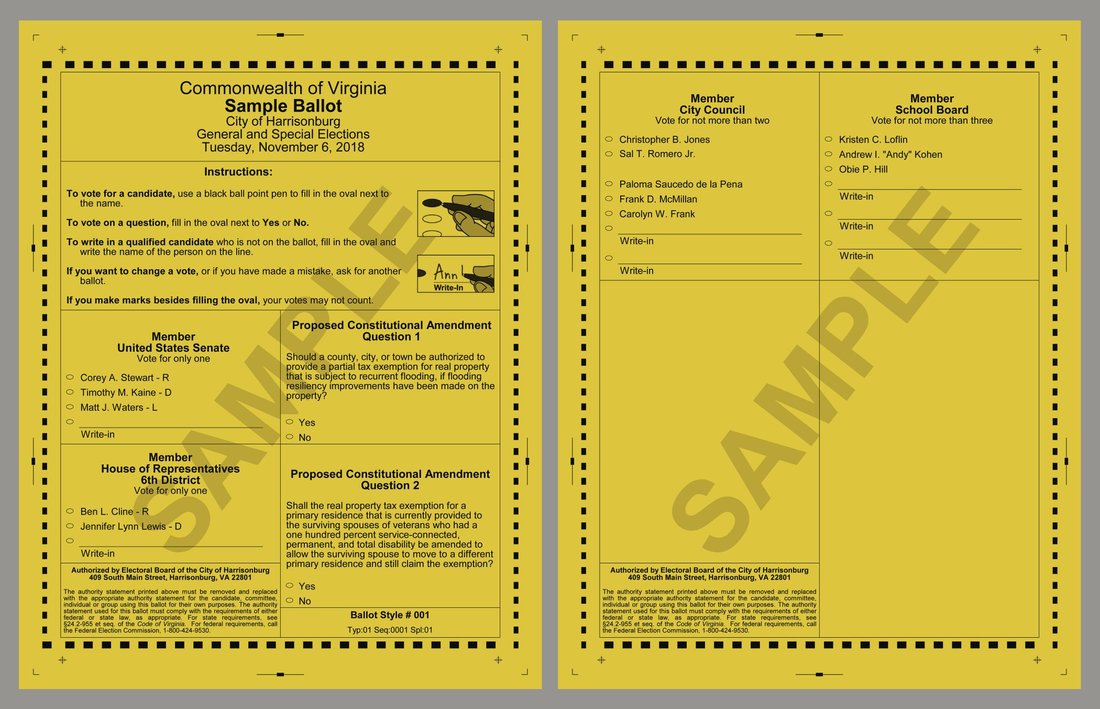

Here is a friendly reminder to go out and vote today. If you aren't familiar with the candidates, JMU provided this helpful overview of those running.

You may be less familiar with the proposed constitutional amendments being proposed on the ballot tomorrow. If you are unsure about the details regarding these amendments, some details below may help: Question 1: Regarding property tax exemption for flooding Currently, Virginia’s constitution states that all properties shall be taxed, with a few specific situations in which exemption or partial exemption can apply. In this new proposed amendment, a partial tax exemption can be provided if your property is subject to recurrent flooding, but only if improvements have been made to address the flooding. Question 2: Regarding property tax exemption for spouses of veterans Currently, Virginia’s constitution requires the principal place of residence of any veteran that is 100 percent service-connected to be tax exempt. This tax exemption is also provided for a surviving spouse of such a veteran, so long as the spouse continues to live there. The new proposed amendment would allow the surviving spouse to continue to claim the tax exemption even if he or she were to move to a new primary residence. These questions will appear directly on the ballot, and all you will need to fill in a yes or no as a response. Additional Resources: Department of Elections Resources Virginia Department of Veterans Services - Overview of Current Real Estate Tax Exemptions

0 Comments

Leave a Reply. |

Categories

All

|

Email - Click Here

Phone - 540-246-9067 Website - www.mattiasclymer.com Schedule a Meeting, Download Contact Card, Etc... |

Funkhouser Real Estate Group | 401 University Boulevard, Harrisonburg, VA 22801 | 540-434-2400 | ©2021 | Privacy Policy | All rights reserved.

Licensed in the Commonwealth of Virginia

RSS Feed

RSS Feed