|

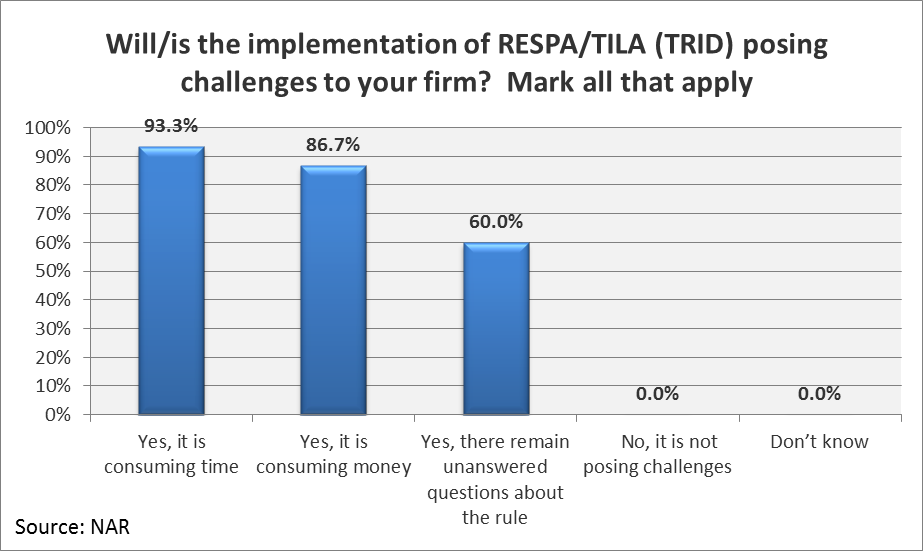

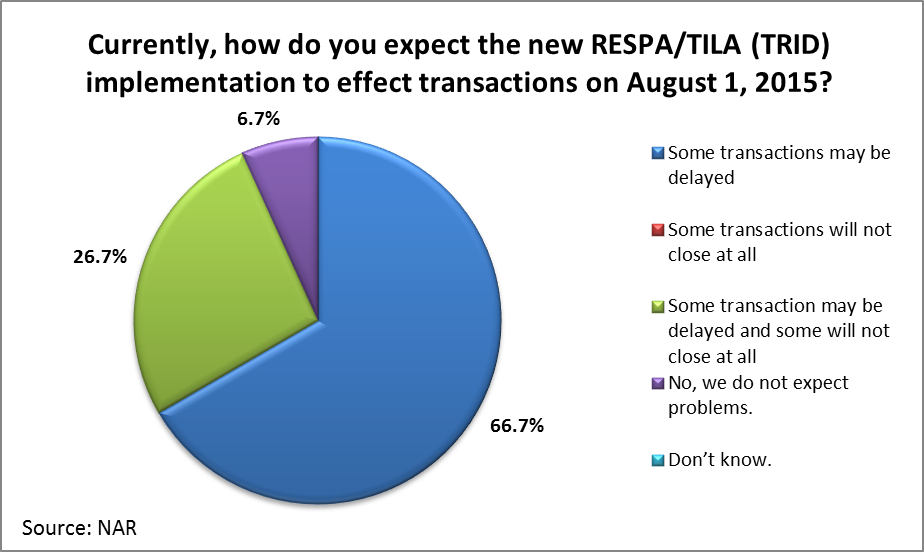

The Consumer Financial Protection Bureau is requiring all lenders to begin using new closing documents on August 1st. The new documents are an attempt to make the process smoother and offers more consumer protections. The short hand for these forms are TILA RESPA Integrated Documentation. The even shorter hand is TRID. As with any change, there are people who welcome the adoption and there are people who are more hesitant to change. Regardless of personal preferences surrounding change, what are the logistics of this upcoming change? How are lenders affected by this process? And what will this mean for the consumers? The NAR asked lenders these questions in the 1st quarter Survey of Mortgage Originators. Unsurprisingly, the survey found that lenders were spending time and money to be in compliance with the change. In addition, 60% of those surveyed said that they still have unanswered questions. The majority of of lenders state that they expect some transactions to be delayed. More shockingly, 26.7% percent of lenders surveyed think that some transactions will be delayed and some will not close at all. It is important to keep in mind that these stats are coming from opinions of mortgage originators. As mentioned earlier, everyone has their own perspective on change which influence their perception of how this may play out. I would venture to say that while these changes may cause short term delays, they will not have significant impacts on the real estate market long term. Source: Realtor.org

0 Comments

Leave a Reply. |

Categories

All

|

Email - Click Here

Phone - 540-246-9067 Website - www.mattiasclymer.com Schedule a Meeting, Download Contact Card, Etc... |

Funkhouser Real Estate Group | 401 University Boulevard, Harrisonburg, VA 22801 | 540-434-2400 | ©2021 | Privacy Policy | All rights reserved.

Licensed in the Commonwealth of Virginia

RSS Feed

RSS Feed